In America, the Securities and Exchange Commission voted in December to require the use of interactive data for financial reporting. By “interactive data,” the SEC is referring to unique computer recognizable tags which make large amounts of information, like SEC filings, searchable by investors and by search engines on the Internet.

No change of this magnitude comes with an instant-on time frame. Indeed, there is a phased-in schedule that begins with the largest US companies being required to use the new interactive data in their first quarterly report that ends on or after June 15, 2009. So, for companies using a traditional calendar year, their second quarter filing for 2009 would be required to make use of the interactive data format. The next wave of publicly traded companies would have a June 15, 2010 deadline. Mutual fund companies (and others) are required to follow suit beginning in 2011.

IDEA – Interactive Data Electronic Applications

The new reporting system is called Interactive Data Electronic Applications, or IDEA, in a futile attempt to somehow force a positive sounding acronym from the new reporting mechanism. To ensure the system is ready to go, the SEC has a voluntary program where some companies are already using the IDEA system. Investors can access the system at idea.sec.gov.

Investor Relations’ New IDEA?

Regardless of whether a company is in the first wave of publicly traded corporations to be required to use interactive data and IDEA, it will be important for IR to be ready following the June 15, 2009 transition date. As many professionals in investor relations are aware, a large part of the population seem at times to only read or grasp headlines without properly grasping all the salient details that accompany them. Thus, when the masses hear a news story about the new SEC mandated interactive reporting system going live, it isn’t a stretch to assume that they’ll be pounding on the IR web pages of companies all over the Internet.

What Investor Relations Can Do For IDEA:

- Have a Prominent Link to the IDEA System on the SEC Site. – Although the IDEA website is an SEC provided location, confused investors are likely to come looking for the new reports on the company’s website. Having a prominent link displayed front and center will alleviate confused investors becoming agitated or contacting IR personnel.

- Display the Company’s “Live” Date In Big, Bold, Colorful, Letters. – Investors may well be under the impression that all publicly traded companies are required to report in the new manner during that first quarter. To avoid confusion and investors getting the wrong idea about the company’s compliance efforts, a large impossible to miss announcement about the date the company is required to begin reporting in the new format should be displayed. Such a posting should trigger the light bulb in user’s heads and make them to realize that not everyone is using the system yet, nor are they required to.

- When Using IDEA and Interactive Data, Provide Some Explanation – Some investors may get the impression that there is more to the system than their actually is. In fact, it is likely that some investors may be disappointed that there isn’t something else in the new reporting. A single page explaining what interactive data is, and how it may be useful to investors can go a long way. Further links to the official information on the SEC website will be helpful as well.

- Provide Press Releases and News Articles – Post a copy of any press releases or other news articles that might help investors understand the new system, both before and after the company begins using it. These sources may contain pointers to interactive services that actually use the data which in turn can avoid the flood of questions to IR relating to what an investor is actually supposed to “do” with the new data. Since the point of the system is really search-ability, of information, investors who already knew how to find what they were looking for in the old EDGAR based system may wonder what the fuss is about.

A few easy proactive steps can save the company IR department countless hours of unnecessary emails and phone calls (though that can’t be fully eliminated) as well as give the impression of being forthcoming regarding a high visibility regulatory change. Make plans now to go live with content and links in early June when the first news outlets start reminding investors to “look for” the new reporting methodology. Have additional material ready to go as well if the original content isn’t properly handling the influx of the curious.

A little action now, and a week or two of rushing and stumbling can be avoided.

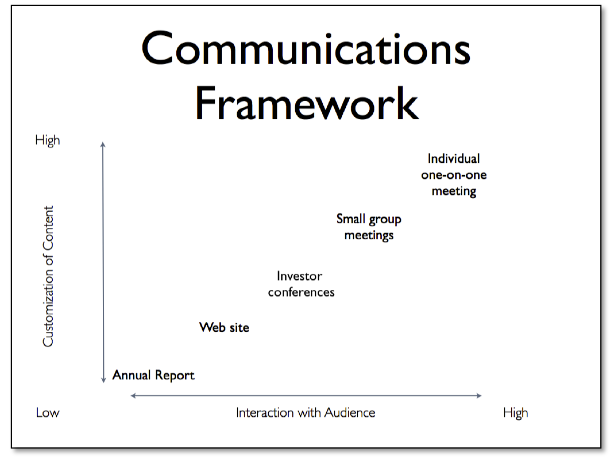

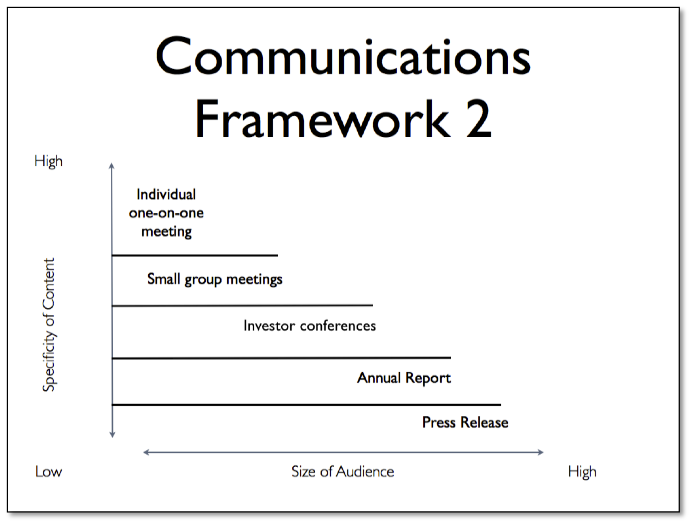

We live in an age of multiple information channels.

We live in an age of multiple information channels.