Recently, we covered the SEC’s Interpretive Release in some detail. One area of concern in that document revolved around companies providing links to third-party information. The particular example cited by the SEC was a company that provided links to just a few analysts, all of whom had favorable opinions of the company. The suggested solution to such concerns is to list several analysts without regard to their opinion of the company.

Here we take a look at Tate & Lyle’s list of analysts as displayed on their Investor Relations website. Such links provide valuable information for investors. Not only do the links allow investors to quickly find professional analyst coverage of a company, but they also demonstrate to some extent the kind of coverage the company gets from the analyst community. Thus, the concern of the SEC that someone might see such a list and assume that the two or three analysts listed represent the whole universe of coverage. So, if a company can provide very beneficial information to investors while at the same time not running afoul of any hint of underhandedness, then we have a winner.

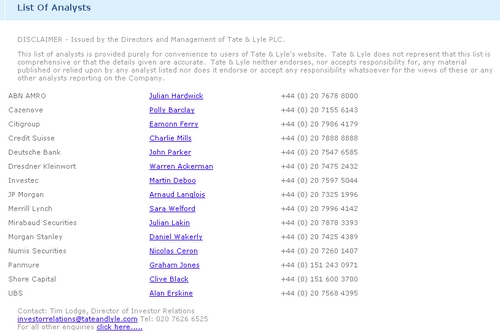

First, the Tate & Lyle page includes a disclaimer at the top of the page frame before the listing of analysts. This is good positioning as it ensures that any investor who reaches the page should see the disclaimer. The disclaimer specifically states that Tate & Lyle only provide the links for the investor’s convenience and that the do not warrant the accuracy of the information behind them. Further, the disclaimer also points out that the list is not comprehensive. We’ll turn a blind eye to the phrasing, “…nor does it endorse or accept any responsibility whatsoever…” (Has a court ever ruled that not accepting responsibility is a weaker standard than not accepting any responsibility whatsoever?)

The one concern is the decision to make the disclaimer a light gray text. While this is standard procedure for disclaimers in general and especially for those in printed text, in the case of IR, it may be better to error on the side of blaring, rather than aesthetically pleasing. Frankly, it would be preferred if the disclaimer were both in full black color, and a larger font. In fact, going all the way to bold may even be advisable.

Still, the disclaimer certainly makes the grade.

What about the list?

The list of analysts covers 15 names and companies. Fifteen names most definitely can be considered a broad list assuming that the 15 were not cherry picked for their positive views. If there were 20 analysts with coverage and the only five with negative comments were the ones missing, I think we can all see how that would be a flashing red light.

The analysts and companies listed represent a cross section of the biggest names in the investment and analysis world in both Europe, and the U.S. One can hardly fault a list with these kinds of names.

What is particularly intriguing is that Tate & Lyle has chosen to link analysts via email address. Many companies that provide a list of analysts fear to link at all. Even the mighty Google, whose bread and butter are Internet links, chooses to not link to the analysts or even the main page of the companies they work for. The tactic by Tate & Lyle is an interesting one. By providing an email link, the IR site is more helpful than a simple list, or even a list with names and addresses as other companies have done. At the same time, Tate & Lyle does not explicitly link to any information regarding the company, but rather only to information about how to contact people who cover the company.

So, the list gets a passing grade as well.

Best Practices

The Tate & Lyle site provides a solid example of what an analyst coverage page might look like for an IR site. Using a large list, and a well positioned and well worded disclaimer are the keys to success with this form of investor information. As an added bonus, it always looks good when your company seems like it is not afraid of the analysts.