Bowen Craggs point out the great new approach that the British Library have taken to their annual report – the inclusion of video profiles of their executive team in the corporate governance section, discussing the Library. The chairman and chief executive have separate pages, each with several more video clips on. The video profiles for the management team all come with transcripts and biographies.

Bowen Craggs point out the great new approach that the British Library have taken to their annual report – the inclusion of video profiles of their executive team in the corporate governance section, discussing the Library. The chairman and chief executive have separate pages, each with several more video clips on. The video profiles for the management team all come with transcripts and biographies.

[Read more…] about Annual Reports: the new-look British Library

Responsible Business Summit: 15 Thoughts

Earlier this week I was lucky enough to attend the 12th Annual Responsible Business Summit in London which was superbly hosted by Ethical Corporation. Having predominantly experienced investor relations conferences, I was full of enthusiasm for the wealth of new information and ideas about to assault my senses, and two full days later, I am pleased to say that it was an incredibly interesting and perhaps I could even say, an inspiring event.

A real effort was made by the organisers to keep the sessions interactive and to use technology to engage the audience. We voted via Twitter and SMS on the best presentations from companies on subjects such as “Frontline supply chain engagement to enable ethical sourcing”, “New models for investment using social innovation” and the final session, “Stakeholder Engagement X Factor”.

I attended eight sessions over the two days and met a number of people from large plc’s to small suppliers from the UK and much further afield. The most memorable moments were when those presenting spoke with genuine passion for their subject, of particular note was when the President of the Norwegian Red Cross spoke about the importance of trust for their organisation during his recent visit to Damascus. Only with complete trust from both the rebels and the regime could they have full access to treat those who needed it the most.

The Chief Executives of both BUPA and O2 spoke about trust and what it meant to their companies. The general theme was a focus on transparency, using technology for more open communication, and employee empowerment. In addition, it was accepted that mistakes will always happen and whilst efforts will always be made to minimise those, it was actually a zero tolerance towards not learning from failure rather than failure itself.

This is a very interesting concept and something that we have been speaking about for the last few months internally. Being open about your challenges as a business is absolutely the right approach, and as Sven Mollekleiv of the DNV Group said, “no customer has complained about telling the truth, this creates trust”.

So, what did I learn that you might find useful? In no particular order of importance, here are fifteen quotes/ideas (as accurate as my note-taking would allow) and tit-bits of feedback that you might find interesting:

- The roles of NGO’s and big business in effecting change from an environmental and societal position is paramount, but collaborations between them needs to be carefully considered to ensure transparency and clarity around objectives.

- Corporations need to work hard with their supply chain, especially in emerging markets to ensure that proper standards are being followed, and that they should make long term commitments to their suppliers so that where change is necessary, that price increases can be accommodated (the Bangladesh factory collapse was referenced here).

- Businesses that have moved from the “Command and Control” model to the “Participate and Persuade” world have enjoyed far greater financial success.

- Societal contribution is potentially of greater importance to businesses than charitable, supply chain or energy reduction policies.

- For businesses to rebuild trust they must identify stakeholders, create adequate listening posts and create strategies for engagement based on the data available

- Shareholder activism and proxy voting is putting new issues on the table as investors start to drive agendas.

- Analysts are starting to ask questions about resource scarcity, water usage, production processes etc. as they start to understand the importance of strategies to adequately deal with these challenges.

- Investment firm Calvert are releasing an app for individuals to track their water usage in order to raise awareness so that they force companies to disclose the same

- You can monitor which companies are best at innovation with responsible business practices as it is integral to their strategy, reporting, results announcements, independent reporting etc…

- Companies cannot break off manufacturing from the brand, and so their reputation is dependent upon their process

- The focus on the supply chain by corporations will become more important as the impact that can be made both financially and from a societal and environmental point of view by making improvements through responsible practice and collaboration is fully understood.

- Supply chain audits and reporting will become commonplace and incorporated into reporting cycles in the next two to three years.

- There is no silver bullet when it comes to crisis communications, but effective scenario planning is absolutely critical in understanding roles and responsibilities during such events.

- Large multinationals have to be careful to align their loyalty to national interests rather than political interests in order to retain neutrality and customer loyalty during government changes.

- That many companies will start to publish their CR Report online—and only online. The digital revolution is not quite as transformational as responsible business practice, but it can certainly save a tree or two.

Life After The Financial Crisis Inquiry

The US’ Financial Crisis Inquiry has concluded with a set of damning conclusions (PDF). These are:

- it was totally avoidable and caused wholly by people’s catastrophic mistakes

- failures in regulation and supervision had a devastating effect

- failures in boardrooms were a key cause

- excessive borrowing, risk and a lack of transparency were all exacerbating factors

- the US government’s ill prepared response added to the turmoil

- there was a systematic breakdown in accountability and ethics

- mortgage standards were the trigger (but not the cause)

- the removal of the regulation of over-the-counter derivatives was a significant contributing factor

- failures in the credit rating agencies drove the crisis forwards.

This is nothing short of a manifesto for regulatory reform along CSR lines. The question is, will it happen? After all, with a lack of regulation being the second item on the list, can business trust the government to give it the medicine it needs?

Unfortunately, it also raises huge questions about the ability of businesses to self-regulate and take steps where government doesn’t direct them. So can we trust corporations to do this now? That seems almost as unlikely as getting strong CSR based legislation.

Now it may seem unfair to tar all politicians and all businessmen with the same brush, especially when the crisis is focused very firmly on the financial sector and treasuries alone. The trouble is that in a capitalist based society this is the heart of all other activity. These are the leaders others follow and attempt to emulate: so even if you’re a follower at least some of the tar from the brush has probably spattered you. Us. Us all.

So here are some key things (in no particular order) I believe should come out of this as lessons learned:

- it’s not all about money; non-financial reporting now has to be seen as just as important as financial reporting; attempting to squash everything into the pounds and pennies bottom line quite simply doesn’t work

- regulation should no longer be seen as the lowest common standard; compliance must cease being a box ticking exercise; the legal framework should be seen as a foundation to build upon, not an exercise in pseudo-morality

- transparency has to become the new watchword of politics and business alike; commercial confidentiality can no longer mean keeping everything secret except mandatory disclosures; instead, everything has to be disclosed unless there is a clear case that it will compromise patents etc; competitiveness must now be about the delivery of quality services and products, not backroom deals

- no company must ever be too large to fail; a resilient and sustainable economy can only be built around smaller organisations which are independent from one another and yet networked closely together; as soon as a single point of failure presents itself it must be removed forthwith; this may mean a decrease in overall efficiency but if it builds in long term stability and reliable growth what’s the problem?

I’m perfectly aware this is me firing off a few rounds from a 12-bore shotgun and that there’s plenty of contentious issues in what I’m saying.

So please, rather than just taking issue with what I think, let’s talk about what you think. Where should the business and financial world go from here?

Picture Credit: Phoenix by David Armano under Creative Commons Attribution License.

Enchantment and the Corporate Site

Sometimes – not nearly enough – I am so taken with a corporate website that I want to be part of that company. Something about the way they portray themselves, their culture or their industry appeals.

Sometimes – not nearly enough – I am so taken with a corporate website that I want to be part of that company. Something about the way they portray themselves, their culture or their industry appeals.

This isn’t just about the career sites, either. Some companies manage to convey something new and intriguing about themselves in the other stakeholder sections too.

Some of them, of course, deliberately set out to change people’s perceptions of the company as part of a rebranding exercise; others seem to enchant almost accidentally. Part of the enchantment, of course is delight in the unexpected, whether this is crystal-clean copy, information explaining something I didn’t know I was interested in, images showing something truthful and honest about the company culture or site architecture that connects and illuminates.

Since I spend much of my time exploring corporate sites, it’s quite hard to enchant me, so what is it that these rare companies are doing that is so persuasive – and how can others copy this effect?

I recently received a review copy of Enchantment by Guy Kawasaki so I thought I’d see whether he could cast any light on this. My copy of the book is now littered with sticky-notes; there are several ideas I picked up for my own use, but there are also key strands I’ve noted that are relevant to corporate websites. I’ve paraphrased Guy’s points, because he isn’t writing about websites, but it is interesting to see how many of his thoughts apply.

I recently received a review copy of Enchantment by Guy Kawasaki so I thought I’d see whether he could cast any light on this. My copy of the book is now littered with sticky-notes; there are several ideas I picked up for my own use, but there are also key strands I’ve noted that are relevant to corporate websites. I’ve paraphrased Guy’s points, because he isn’t writing about websites, but it is interesting to see how many of his thoughts apply.

- Imagine yourself as the person you want to enchant, and ask: what does this person want from their visit? Ideally, a website would be designed with the visitor in mind, but this isn’t always so. It’s always good to see a site set out to make it easier for the visitor to find what they need, quickly.

- Be likeable: use clear language – simple words, the active voice. Keep it short and unambiguous, avoiding internal language, culturally-specific language, and corporate-speak.

- Be trustworthy: help the visitor by providing high quality information; demonstrate expertise; disclose where appropriate; make it clear what you stand for, what you do, and what your goals are.

- Smooth their path. Make it easy for visitors to interact with you and to achieve what they set out to do. Design the site to eliminate obstacles – user experience testing, anyone?

- Tell a story; plant many seeds. Who knows when something that you say or do on the web, whether at your social media outposts or on the main corporate site, will have an effect on your visitor, and move them towards action: investing, buying from you, selling to you, working in partnership, applying for a job, writing a story about you, commenting to others… Remember to talk to the influencers of your audience too: the wider community.

- Build an ecosystem (or community). Guy’s backstory includes working as evangelist at Apple, which has a huge community of enthusiasts who talk among themselves about the Apple products. But there’s no reason why other companies shouldn’t engage their stakeholders in discussion, encouraging criticism and new ideas, feeding back some of this discussion to the website to make it clear that the company is listening. And this is a valid approach for more than just product design or customer service.

- Get people and your story together, whether using push or pull technologies – enabling, and optimising for, whatever technologies, browsers and devices your audience prefer.

None of these strands should be news. But this isn’t easy to implement – we know that – which is why finding sites where it is done well is such a delight.

Ethics And Executive Compensation

Recent headlines have chronicled the ubiquitous debate on Executive Compensation and its relationship to the financial crisis. This debate is not new and has been going on since the 1990’s. However, the current financial crisis places a new focus on the topic and has revealed some exorbitant practices. A recent Wall Street Journal article by noted management guru Gary Hamel indicates —

We can hope, though, that the current crisis will bring leaders to the fore who have the virtues we have always sought in those who manage our nation’s financial institutions: honesty, humility, prudence, foresight, and a keen sense of stewardship. It is these qualities, more than any amount of regulation or recapitalization that will rebuild the foundations of America’s financial system.

WSJ, October2, 2008

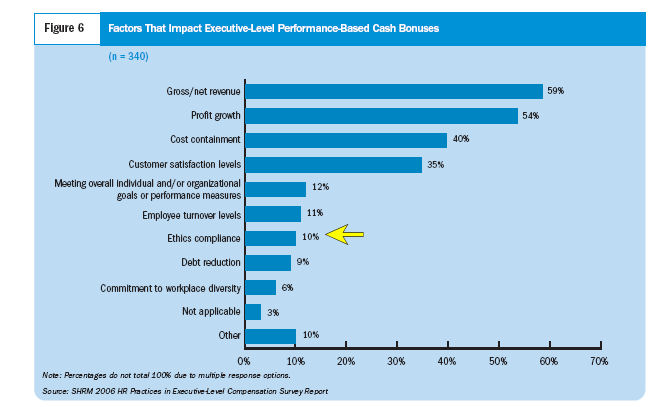

Executive Compensation is a key Corporate Governance issue and Boards have been, for the most part, derelict in their responsibilities to oversee compensation and ensure ethical practices. For example, in a Society For Human Resources 2006 Survey, Ethics Compliance accounted for only 10% in factors determining cash bonuses.

We are in the midst of a tectonic-plate movement in the financial world that is shaking the ‘real’ world quite dramatically. My purpose here is not to review the causes and potential consequences of our current situation, but to explore the possibility that once again, in the world of publicly traded companies, boards of directors have let us down.

DAVID BEATTY Globe and Mail Update December 9, 2008 at 6:00 AM EST

Well, not all Boards “let us down”.

Here are a few companies that consider ethics factors in determining executive compensation —

- Ventas (one of the nation’s leading healthcare real estate investment trusts (REITs).) For 2007, the value of the long-term incentive award was based on the accomplishment of a series of corporate objectives, including total shareholder return (absolute and relative to the Company’s peers), the integration of the assets and operations acquired through the Sunrise REIT acquisition, FFO per share growth, effective diversification, balance sheet management and capital markets execution, business ethics and reputation and individual performance.

- Sempra Energy (a Fortune 500 energy services company) The committee annually will review its principles and policies for executive compensation and related compensation programs in light of the corporation’s current and prospective business environment and other relevant factors including, but not limited to: The need to recruit and retain executives of outstanding ability and proven experience who demonstrate the highest standards of integrity and ethics.

These companies understand that compensation drives behavior and that including ethics in executive pay will contribute to avoiding Warren Buffet’s warning —

Earnings can be pliable as putty when a charlatan heads the company reporting them.

5 stages of development of corporate RSS Feeds

Not all companies have yet ‘got’ the value in providing RSS feeds, and don’t provide any at all; at the other extreme, some companies provide multiple RSS feeds, including feeds of podcasts, speeches and other tailored streams of information.

There is definitely a trend towards providing more RSS feeds, and providing feeds tailored to a particular audience.

people delete feeds that aren’t tailored to their needs

I’ve noticed that major companies tend to fall into one of five different groups, depending on where they are on the RSS curve:

[Read more…] about 5 stages of development of corporate RSS Feeds