Corporate governance attracts much public attention since it purportedly involves the economic-financial health of corporations and society in general. However, corporate governance is poorly defined because it typically is composed of differing mix of policies, procedures, internal practices all surrounded by laws and regulations.

Simply put –

…the overall purpose of corporate governance, which is to align as nearly as possible the interests of individuals, corporations and society.

Theories of Corporate Governance Edited by Thomas Clarke

OK maybe that’s too simple. Here is a definition from Investopidia —

“Good corporate governance is a situation in which a company complies with all of its governance policies and applicable government regulations (such as the Sarbanes-Oxley Act of 2002) in order to look out for the interests of the company’s investors and other stakeholders.

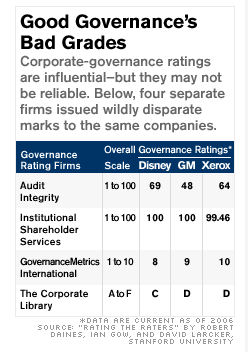

The corporate need to be in compliance with corporate governance has shaped an industry of advisers, rating firms and other services with an estimated 2008 sales of $52 billion (corp-integrity.com). Perhaps the most influential of these companies are the rating agencies. These firms – which include the Corporate Library and RiskMetrics Group’s ISS Governance Services and S&P – analyze companies against their own criteria and rate whether a company is well governed or not.

These ratings may influence a company’s cost of capital, equity share price and shareowner relations. As such, the companies that compile these ratings have achieved a significant presence in world financial markets. But, there are some problems — extensive studies indicate these ratings bear little relation to actual corporate performance. A recent Fortune article summarized a Stanford University study widely different ratings for individual companies.

The Stanford researchers summarized their findings–

We examine these claims for the commercial corporate governance ratings produced

for 2005 by Audit Integrity, RiskMetrics (previously Institutional Shareholder Services),

GovernanceMetrics International, and The Corporate Library. Our results indicate that the level of predictive validity for these ratings are well below the threshold necessary to support the bold claims made for them by these commercial firms.(Emphasis added) Moreover, we find no relation between the governance ratings provided by RiskMetrics with either their voting recommendations or the actual votes by shareholders on proxy proposals.

Rating the Ratings: How Good Are Commercial Governance Ratings? Rock Center for Corporate Governance Stanford University

A summary of this report is available. The Stanford study is one of a number of other similar studies that question the value of these ratings agencies. Some common themes in these studies include —

- Over reliance on quantitative accounting/financial criteria

- “You can’t legislate compliance”

- More emphasis needed on observable qualitative criteria, such as corporate culture, drivers of employee behavior and corporate integrity practices.

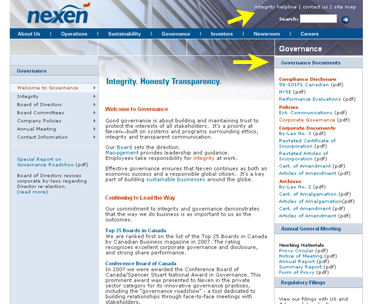

This post only touches the surface of this important subject. Future posts will cover additional aspects of Corporate Governance ratings and related topics. In the meantime, here is a Canadian company that just might be a model of effective Corporate Governance practices —

Note the focus on Integrity, the public display of an “Integrity Hotline” and a clear display of compliance documents. Criteria the rating agencies miss.

Ed Konczal has an MBA from New York University's Stern School of Business (with distinction). He has spent the last 10 years as an executive consultant focusing on human resources, leadership, market research, and business planning. Ed has over 10 years of top-level experience from AT&T in the areas of new ventures and business planning. He is co-author of the book "Simple Stories for Leadership Insight," published by University Press of America.