We all have a water footprint; some of us have larger ones than others. (You can assess your personal water footprint here)

We all have a water footprint; some of us have larger ones than others. (You can assess your personal water footprint here)

Companies also have water footprints, and this will vary across sector: if you’re a services provider, then your footprint will inevitably be smaller than if you use water as part of your operational processes.

Increasingly companies are responding to public interest and awareness of water use by providing information about this on their corporate website.

Water and Responsibility

Some companies make no mention of their use of water at all, while others provide detailed information about their own use, and run CSR campaigns around water issues. Examples of water-oriented programmes include:

- water safety, e.g. the dangers of their reservoirs (Example: United Utilities)

- water leakage (Example: United Utilities)

- environmental conservation (Example: Coca-Cola)

- reduction of use (Examples: IHG plc and British Land)

- provision of clean drinking water (Examples: Proctor & Gamble and Siemens)

- disaster relief in response to flooding (e.g Nokia)

- Reed Elsevier offers a prize as part of their Environmental Challenge programme for innovative ideas to improve access to a safe and sustainable water supply.

There are many more water-oriented programmes, big and small, being run by large companies across the full range of water-related issues, but if you haven’t been to see the SABMiller pages on their Ten Priorities, then you should: look at the water priority page for an excellent example, not forgetting to check all the tabs.

Water and Business Risk

Water scarcity is a significant future risk, and one that is engaging the minds of governments and forward thinkers already. It is also a risk to business, particularly ones which are highly dependent on water operationally. Other water-related risks exist, such as risk of flooding, risk of water pollution and risk of damage to marine environments.

SABMiller have produced a report on water scarcity and business risk. Brewing is highly water-intensive, and so water plays a large part in their business, but water scarcity could be a risk to other businesses too.

Water and Reporting

Because of the highly publicised Gulf of Mexico spill of oil into water earlier this year, I thought it would be interesting to review a corporate site in the oil and gas sector, and see how they approach their water reporting.

I’ve chosen to explore BG Group, which finds, develops and connects natural gas to markets worldwide.

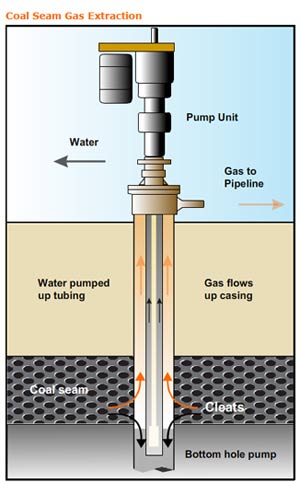

Helpfully, BG Group provide an explanation of how water is used in at least part of their business: to produce coal seam gas, they drill wells, and pump water out of the coal bed, freeing up the gas to flow out of the rock. This isn’t an obvious process to those of us who aren’t in the business, and so this is useful educational material.

BG Group and water: environmental risks

BG Group identify 5 potential environmental consequences of their business activities: 3 of these are water-related:

- the impact of wells, pipelines and other infrastructure on marine ecological habitats and biodiversity

- the release of hydrocarbons or chemicals into water

- use of scarce water resources or the production of excess waste water.

Although water scarcity isn’t explicitly stated as a business risk in the extensive set of risks provided in the Risk section of the online annual report, the risks of oil/chemical spills and damage to the environment are included. And water management has been identified as a material issue.

BG Group and water: environmental strategy

While the unconventional gas resources being developed may be able to reduce the overall greenhouse gas emissions, their production requires careful local environmental protection, including:

- the treatment and disposal or beneficial re-use of salt water produced by coal seam gas wells

- the management of the water used to fracture rock to release shale gas

- the hydro-geological effects of water abstraction and water injection, including the impact on local groundwater sources

BG Group are basing their water measures on UK, EU and US guidelines; their group-wide water management strategy should be available soon.

BG Group and water: operational explanation

BG Group explain that there are three different aspects to their water impact:

- Freshwater withdrawal, that is, water drawn from:

- Surface water (rivers, lakes, wetlands)

- Ground water (via wells and alluvial sands)

- Piped or trucked water from municipal authorities or other industrial users

- Operational use: as input and as output:

Water is used extensively in shale gas wells. To reduce freshwater use, in Louisiana, USA, BG Group have agreed with a local paper mill to reuse waste water from the paper pulp manufacture.

Water is produced in large quantity by coal seam gas wells. This is saltwater, and must be treated or evaporated before it can be used. BG Group are looking at options to reuse this water for local communities in Queensland, Australia, where there has been a prolonged drought.

- Spillage: either of oil into water, or spills of water.

- Oil into water: BG Group report on spillages and indicate the measures put in place to reduce this

- Water loss: again, details explaining the spills are provided.

BG Group and water: Performance

2009 (the most recent report, and the first year the report was available online only) was an interesting year, water-wise, for BG Group, because it included:

- beginning the development of a group-wide water management strategy (target: 2010)

- reporting on freshwater withdrawal for the first time

- increasing the use of water operationally, primarily because of the acquisition of QGC in 2008

- bringing water produced by the Egyptian and the Trinidad and Tobago operations onshore for treatment, to protect the marine environment

- reporting of produced water has changed to be brought into line with the GRI recommendations

- beginning to collate information about environmental training courses in their competency development system.

2009 was clearly a year in which BG Group began to focus on water management. Data on discharges to water – and which type of water – are available online.

It is unfortunate that their operational water use increased, but acquisition of other companies is bound to bring a variety of issues, and water use should be included among these. Interestingly, water management has only recently emerged as a material issue for the group, following their acquisition of other businesses.

The newest acquisition, QGC should be ISO14001 certified (the international standard for environmental performance) by Q1 2011; it will be interesting to see the changes in water use over time as the water management strategy takes effect.

SABMiller: more beer – less water

Overall, I found that the discussion of water use by BG Group was admirably full, clearly presented and informative. It appears that BG Group are taking their corporate impact on our global water resources seriously, and the details on both controlled and uncontrolled discharges to water are also easy to find and clearly stated. The reuse strategies for both input and output water I find fascinating; perhaps there should be more such partnerships established between industries?

I couldn’t spot any specific water-related targets, and it would be good to see more charts, perhaps something similar to the SABMiller water:beer ratio, to give the visitor an idea of how much water is needed to produce X amount of natural gas. A barrel of oil is a concept that the average visitor – me – can grasp, but a billion cubic feet of gas is more difficult to visualise. How many homes would a billion cubic feet of gas heat for how long?

That said, though, I think this is a commendably detailed approach to reporting on water use by this company, and I look forward to the 2010 report.

What do you think? Could BG Group have done more to report on their impact on our water?

This post is part of Blog Action Day, which this year is discussing water.

Previous contributions to Blog Action Day were:

2009: Climate change and the corporate site

2008: Celebrating the FTSE 100: action on the breadline

2007: Enticing the green investor

Lucy is Editor at Corporate Eye