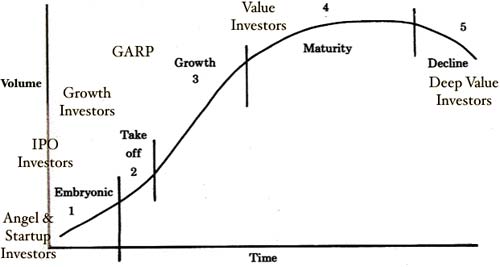

In marketing there is a well-known graph known as the Product Lifecycle Curve, which I’ve set out below.

The graph illustrates how successful products are first brought to market and purchased by early adopters, then go through phases of rapid takeoff and swift growth. Once the product has achieved wide spread acceptance, the growth begins to slows down, eventually reaching a period of maturity. Mature products run their course and inevitably decline sets in.

The speed at which all of this occurs depends in large part on the nature of the industry and the aggressiveness of competitors. Tech gadgets, for example, have much shorter product life cycles than say, breakfast cereals. The exact shape of the curve and the length of maturity will also differ, but the general shape and sequence of the curve holds true for many products.

The interesting thing about the product lifecycle is that it has applicability to a number of other things, corporate lifecycles included. Stop thinking about products and substitute corporate development and the graph doesn’t change. Where this is of interest to investor relations professionals is in the type of investors each phase of the cycle attracts. Set out below is the same graph with investor segments sketched in.

One of the interesting things about the graph is that as you move on the life cycle line from left to right, the price/earnings ratio that investors are willing to pay for a stock declines. This is because investors perceive that the rate at which future earnings will accrue to the company is slowing and they are therefore willing to pay less for that future stream of lessened earnings. Growth investors are well known for their penchant of “paying up” for future growth, while value investors are almost religious about not over paying for a stock.

Companies often struggle with this, particularly at the inflection points between stages. Company executives will say, “We’re a growth company – look at our past record. The market is undervaluing us.” Investors, on the other hand, will look forward and say, “Nope, you’re a mature company. Your big gains are over and we’re not going to pay a premium for a company that is going to grow at the rate of the market.” Many an antagonistic relationship has been fostered based on this differing view of the world.

Understanding where your company stands on the lifecycle graph can help an investor relations person understand how the street may be viewing you.

John recently retired as a Lecturer in Management at Rice University’s Jones Graduate School of Management, where he taught investor relations. Prior to that, John was in charge of investor relations for Sysco Corporation and Walgreen Co. He holds a MBA from the Kellogg Graduate School of Management at Northwestern University and a law degree from Loyola University of Chicago.

You can learn more about John’s thinking about investor relations at his blog, Investor Relations Musings.