In my last post I looked at some of the things companies are doing with charting to help investors. In this post I”ll examine some of the less obvious ways companies can help investors gain insight into their operations.

Glossaries – I found sites that provided a glossary very helpful. Every industry has its acronyms and special catch phrases and to the extent these can be explained and accurately defined, a lot of questions and head scratching can be eliminated. In retail, for example, a common measure is same store sales, but many companies calculate it slightly differently. A clear definition of how the measure is calculated can save both investors and investor relations officers a lot of heartburn.

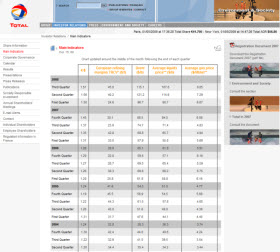

Along similar lines, but even more interesting, is a feature I came across consisting of a page that discussed other, non-company indicators as they may affect the company. An obvious example, (I live in Houston) is the link between the price of oil and the performance of the oil companies. Other companies have exposure to things such as inflation, commodity prices and consumer spending to name a few, and a page where companies gather the data and discuss their outlook on these trends is quite useful not only as a data source, but also as an additional insight into how the company thinks about how it is linked to the greater economy.

Finally, while most companies today provide links to their recent earnings conference calls, very few provide a transcript of the call. Although you miss the tenor of the speaker’s voice when you rely upon a transcript, it is a more time efficient way of reviewing a conference call. It would be fairly simple for most companies to post a transcript and save us all the additional hassle of going over to the Seeking Alpha web site to get it.

None of these items requires a lot of programming or a large investment of time and effort to accomplish, but I rarely see anything of this nature on corporate IR sites. A little bit of creative thinking by investor relations staffs could really help their sites become much more investor friendly.

Lucy is Editor at Corporate Eye