These days having the annual report somewhere on the Investor Relations website is all but a given. While some companies publish just a PDF version of the printed document, others publish a web or HTML version. This published data no doubt meets the expectations of the average investor. Indeed, such easy access to annual reports is a great improvement over the days when the most the average IR site offered was an electronic way to request the standard snail mail delivery of the annual report. However, there are some companies providing even more service to their valued investors.

Downloadable Spreadsheet Data

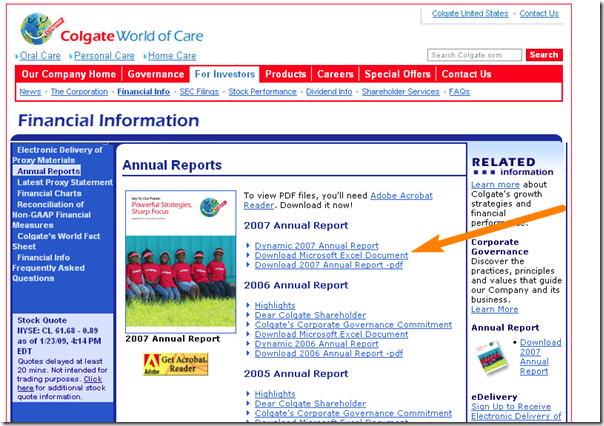

At Colgate’s Investor Relations website, they provide the usual Annual Report options. There is a link for a PDF file for investors who like to download and view their reports offline, as well as a link to an online Annual Report. But, there is one extra link. It is for the Annual Report numbers as a Microsoft Excel document. (I will refrain from making any comments about the garish color scheme – Oops.)

When it comes to investors there are all types. Some investors care about technical analysis, or analyst recommendations, or even news reports. Ask around long enough, and you’ll even find investors – some successful – who will admit to just using “their gut.” But, one type of investor cares about numbers, and not just the headline numbers either.

When it comes to investors there are all types. Some investors care about technical analysis, or analyst recommendations, or even news reports. Ask around long enough, and you’ll even find investors – some successful – who will admit to just using “their gut.” But, one type of investor cares about numbers, and not just the headline numbers either.

The numbers investor wants to crunch data. They want to calculate all those ratios that don’t come printed on the fact sheet. They might even have a few ratios or formulas of their own that they use to help make their investment decisions. Either way, before they can do anything else, they need those numbers in the annual report in some electronic format.

Generally, this involves subscribing to a service, or manually exporting values from an investing website or portal. And, when all else fails, good old typing them into the computer from the page.

The Excel file on Colgate’s IR site eliminates the middleman and gives investors the raw hard numbers in a format that is easy to manipulate and export to whatever program or service they choose.

The Colgate Excel file contains nothing new or out of the ordinary, but it does make accessible the important numbers from the Annual Report. Inside is the income statement, balance sheet, retained earnings, cash flows, and the 10-year financial summary. Each of these is separated out as an spreadsheet page and most contain data multiple years of data (usually back to 2005).

Benefits for IR

While this additional data may seem to be all about giving something more to company investors, it also provides a benefit for the IR Department and the company itself.

By providing its own Excel file, Colgate can ensure that ALL of the data goes with the numbers. The 10-Year Financial Summary for example contains 6 footnotes on the numbers shown. This ensures that investors looking at these raw numbers are getting that all important context. Data provided by third-parties may or may not pass along such information once the raw data has been imported and standardized by whatever system they use. Even if such information is carried through, its placement cannot be controlled by the company. By supplying an in-house spreadsheet, the company can ensure that whatever information it deems necessary shows up in a way that they are comfortable with.

A Little Caution

Of course, releasing information in this way cannot be done on a whim, nor can the data be selectively highlighted or formatted. Straight reproductions of already approved tables within the printed Annual Report are generally the safest way to go and ensure that there is no additional information released within the file.

It is important to ensure that any variations from the exact numbers or formatting in the approved documents is not characterized as commentary on the data. For example, something as simple as making certain lines or numbers bold for better visibility on the computer screen could be interpreted by some as the company drawing emphasis or attention to those numbers or fields. (Or just as bad, as drawing attention away from other numbers or fields.)

Investor Relations Best Practices

While Microsoft Excel Spreadsheets are commonly used they are not the only format available for making electronic information accessible. Comma-delimited files have the ability to be imported into almost any spreadsheet or analysis program. However, the extra portability does come at the expense of readability and the increased chance of errors.

Whatever the format, now is the time to look into electronic distribution of data in this format. Not only does it make the data more accessible to investors, it provides one more avenue of contact for IR. Posted spreadsheets coupled with an email subscription to their updates ensures that investors regularly receive not only up to date data, but a subtle reminder about the company as well.

Ensuring that investors have correct timely data is one of the primary focuses of IR and making available electronic files like this is one more way to do just that.

Brian is a small business owner, consultant and freelance writer. Brian began his professional career in the computer industry as a consultant where he became keenly aware of the internal workings of companies from Fortune 100 giants to small two-man shops. While working with a mutual fund company, Brian developed a strong interest in finance and became a Certified Financial Planner. As a financial professional, Brian specialized in working with small business owners. Brian is the co-founder of ArcticLlama, LLC a premier business writing and consulting firm. He also runs a real world personal finance blog. Brian lives in Denver with his wife and daughter.

I am curious about why Colgate chose to use a proprietary Excel format vs. a standard like XBRL (XML format following standards for financial reporting) for distributing financial data in a way that allows users to customize or analyze the report.

Granted, XBRL requires an investor to have a custom program to be able to digest the data and present it in a human-readable form. But, XBRL has the advantage of being a standard, so investors won’t have to customize the report for each company. Funds and other professional investors would probably prefer an XBRL feed, for that reason.

In contrast, an Excel format will require the investor to manually create formulas for any custom analysis he wants to perform. It would seem to be a good choice for individual investors with a small portfolio and limited computing resources.

Was this initiative driven by requests from investors? Or did the company internally decide to distribute data in this format?

Rene,

You may have asked and answered your own question.

While it is true that Excel is a proprietary format (except the Excel 2008 format has been certified as an open standard) it is also widely known and used. In fact, I think you would be hard pressed to find any application of that type regardless of developer that does not have the ability to import data from Excel. So, in a way, it is a “standard.”

XBRL, on the other hand, while open is not very well known outside of a small community of users. At least today.

So, while I do not have any insight into the internal decisions made at Colgate, I would guess that the decision was likely made based on both the universal nature of Excel among not just investment professionals but savvy non-professional investors as well, and the fact that it is also a little bit easier to create the Excel file.

However, I would guess that the time is coming when your paradigm will emerge victorious. As you may be aware, this is the year the SEC starts requiring the first wave of US companies to file some regulatory reports in the XBRL format. I recently wrote about it here:

http://www.corporate-eye.com/2009/01/interactive-data-for-financial-reporting-and-ir/

So, there is no doubt that the XBRL format will become more and more widespread over the next couple of years.

In the meantime, I belive that there is an XBRL plug-in available for Excel if you are interested. In true Microsoft fashion, the files it generates leave a lot to be desired standards-wise, but it might be a good jumping off point for interoperability purposes.

-Brian