Recent headlines have chronicled the ubiquitous debate on Executive Compensation and its relationship to the financial crisis. This debate is not new and has been going on since the 1990’s. However, the current financial crisis places a new focus on the topic and has revealed some exorbitant practices. A recent Wall Street Journal article by noted management guru Gary Hamel indicates —

We can hope, though, that the current crisis will bring leaders to the fore who have the virtues we have always sought in those who manage our nation’s financial institutions: honesty, humility, prudence, foresight, and a keen sense of stewardship. It is these qualities, more than any amount of regulation or recapitalization that will rebuild the foundations of America’s financial system.

WSJ, October2, 2008

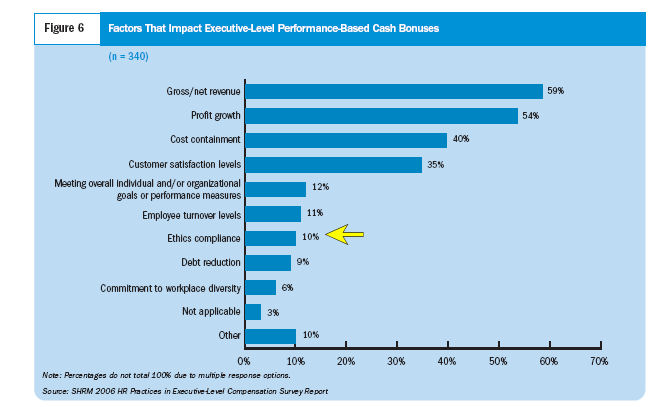

Executive Compensation is a key Corporate Governance issue and Boards have been, for the most part, derelict in their responsibilities to oversee compensation and ensure ethical practices. For example, in a Society For Human Resources 2006 Survey, Ethics Compliance accounted for only 10% in factors determining cash bonuses.

We are in the midst of a tectonic-plate movement in the financial world that is shaking the ‘real’ world quite dramatically. My purpose here is not to review the causes and potential consequences of our current situation, but to explore the possibility that once again, in the world of publicly traded companies, boards of directors have let us down.

DAVID BEATTY Globe and Mail Update December 9, 2008 at 6:00 AM EST

Well, not all Boards “let us down”.

Here are a few companies that consider ethics factors in determining executive compensation —

- Ventas (one of the nation’s leading healthcare real estate investment trusts (REITs).) For 2007, the value of the long-term incentive award was based on the accomplishment of a series of corporate objectives, including total shareholder return (absolute and relative to the Company’s peers), the integration of the assets and operations acquired through the Sunrise REIT acquisition, FFO per share growth, effective diversification, balance sheet management and capital markets execution, business ethics and reputation and individual performance.

- Sempra Energy (a Fortune 500 energy services company) The committee annually will review its principles and policies for executive compensation and related compensation programs in light of the corporation’s current and prospective business environment and other relevant factors including, but not limited to: The need to recruit and retain executives of outstanding ability and proven experience who demonstrate the highest standards of integrity and ethics.

These companies understand that compensation drives behavior and that including ethics in executive pay will contribute to avoiding Warren Buffet’s warning —

Earnings can be pliable as putty when a charlatan heads the company reporting them.

Ed Konczal has an MBA from New York University's Stern School of Business (with distinction). He has spent the last 10 years as an executive consultant focusing on human resources, leadership, market research, and business planning. Ed has over 10 years of top-level experience from AT&T in the areas of new ventures and business planning. He is co-author of the book "Simple Stories for Leadership Insight," published by University Press of America.