Business does not happen in a vacuum, but financial statements are often presented that way. As an investor, you always have to ask yourself if the company results are being driven by the company alone, or by external factors. Of course, usually it is a combination of the two. But beyond some verbiage in the interim results press release, or a brief statement in the annual report, the average investor is often left without any broader context to judge how the company is doing. Further, because active investing is a forward-looking activity, this lack of background will mean that investors will seek their own data sets to help correlate past performance with their judgment as to future prospects. When making decisions about future investments, it’s important to know if the company you are interested in is prospering because of its managerial expertise or because it’s boom times in the industry. Because when things change, as they invariably do, you want to be with good management.

This is a serious oversight by many corporations and represents a missed opportunity to educate investors interested in their firm. Company performance can be heavily influenced by a variety of factors, whether it is interest rates, new construction starts, inflation or a particular type of commodity cost. Investors may or may not have a good handle on these influences. However, company personnel, who spend their days immersed in the details that drive their businesses, know what external factors most affect their businesses. So it makes perfect sense to direct investors to the appropriate information and to make it available on your investor site. Yet few companies do.

There may be several reasons for this. Companies may be understandably reluctant to include information from third party sources on their websites, for one. Or they may be hesitant to deviate from the “cookbook approach” when it comes to financial information. That is, if it is not required to be disclosed, then don’t deviate from the recipe by adding extra spice. Whatever the reasons, it means that investors will have to search on their own for the causal links between internal performance and external effects.

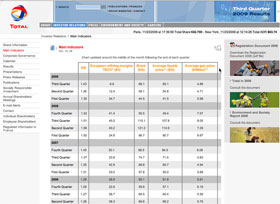

To their credit, some companies do attempt to fill in the gap and point out important external factors. Total, the French energy company, does this on a page in their investor relations section titled “Main Indicators”, which I have reproduced alongside. On that page, Total sets out a chart showing the Dollar/Euro exchange rate, European Refining Margins, the cost of Brent crude per barrel, and average gas and liquids prices, all factors that are of importance to an energy producer. In creating the chart, Total enables its investors to make more informed decisions and saves them a lot of research time. In short, they have made their financial information more effective.

It is something I’d like to see a lot more companies do.

In this series:

Previous post: Financial information

Next post: Provide context

Lucy is Editor at Corporate Eye