It’s a curious thing, but most company investor relations sites do not come right out and state why you should invest in the company. In marketing terms, most sites engage in what can be referred to as a “Soft Sell” where they lay out information for the visitor and allow the visitor to come to their own conclusions. This is a perfectly valid approach, but in certain circumstances a more direct approach may be more effective.

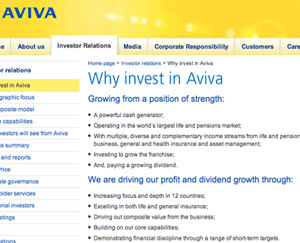

When a company devotes a page on their investor relations site to making the case why investors should invest in their company, they are really telling the investor what they think is important about their company. This is valuable information as it allows an investor to quickly see if the company’s priorities line up with his own. For example, set out below is the “Why invest” page from Aviva, the insurance company. As you work your way through their statement, you quickly get a sense that cash flow, diverse offerings in a large market, growth and increasing dividends are where they put their emphasis. It is a good example not only of what the company offers for investors, but also of the way the company will run its business.

At this point I should point out that it would be unusual to see such forthrightness on an American listed company’s web site. This is because under the United States legal and regulatory scheme, companies are not allowed to make a solicitation to either buy or sell a security, unless that solicitation is either preceded or accompanied by a prospectus.

As a result, most companies choose not to venture into the regulatory tar pit that might expose them to claims of soliciting for the purchase or sale of their securities. It’s yet another example of the unintended consequences of well meaning regulation.

In this series:

Previous post: Search

Next post: Differentiation

Lucy is Editor at Corporate Eye