Investor relations often suffers from what I refer to as a regulatory mind set. Corporations become so fixated on disclosing information in the form and fashion dictated by their local regulations and accounting rules that they fail to step back and ask themselves if they are giving investors enough relevant information to help them make an informed investment decision. Sometimes good disclosure means that companies have to go outside what is strictly required by the rules and describe in plain English and simple numbers what is important.

How a company chooses to disclose the information is less important than the fact that the information is easily available on the website, and in a quick survey of websites I found important information in fact books, as a separate spreadsheet and as a link on a page within the investor section. In all cases, the information went beyond what regulations would specifically call out for disclosure, but provided valuable insight into company operations.

Take, for example, the fact book produced by ENI, the Italian energy company.

The fact book is voluminous, running to 120 pages and anyone who reads it will get a very clear picture of their business. Set out alongside, as just a single reference point, is a map ENI produces showing their plan for major start up facilities during 2010 – 2013.

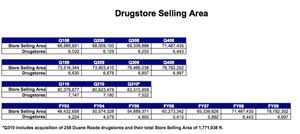

Not everyone has the staff or desire to produce a 120 page fact book, but important information can still be made available on the web site with very simple disclosure methods. The American drugstore retailer Walgreens provides a case in point for this approach. One of the key metrics for any retailer, particularly retailers that are known for growth, is their increase in selling area and units. Reproduced below is a copy of the spreadsheet document Walgreen makes available to investors to compare year over year and quarter over quarter increases in these metrics.

A final example comes from SABMiller, the South African brewer. SABMiller is a company that operates in multiple countries with multiple brands, and as you often hear from vendors in U.S. ballparks, “You can’t tell the players without a scorecard”. SABMiller very wisely places a link entitled Understanding SABMiller on their main investor page which has a variety of links that are quite helpful in giving investors additional insight into the company.

As seen below, one of the links leads to a page on SABMiller brands, which if you were a consumer products analyst following the company, you would find most helpful. (My favorite brand, based on title alone is ‘Brutal Fruit’ although ‘Blue Moon’ comes in a close second.)

To sum up, every company has metrics which are important to its business, but which the regulations do not require to be disclosed. Investors want to know about them, and if the company does not give them out, investors will make their own estimates. Why not be forthcoming with the information and make sure they get it right?

In this series:

Previous post: Press Releases

Next post: Contacts

Lucy is Editor at Corporate Eye