Most company investor relations web sites are entirely equity oriented and ignore the company’s debt. I’m not quite sure why this is, as many companies have a significant part of their funding that is derived from the credit markets. Perhaps it comes from the fact that most corporate debt is held by institutional investors who have access to proprietary trading screens, or perhaps it derives from the fact that the banking and treasury department is often separate from investor relations, but you can look long and hard before you find much information on most companies’ web sites that relates to their debt.

By failing to more publicly disclose this aspect of their financial structure companies are doing a disservice, certainly to retail holders of their bonds, but also to holders of their equity. Debt burden, that is, the total amount of debt your company has, is important information. As is your debt maturity schedule, which will tell investors when your debt comes due, cash flow requirements and how much immediate refunding risk you may have. Rating agency debt ratings are handy shorthand guides to a company’s overall credit quality and also merit attention. In short, there are many important items of information regarding a company’s debt that go into an investment decision, regardless of whether an investor is a debt or equity holder. Usually this information is spread out between the balance sheet, cash flow statement and regulatory filings, or sometimes, in the case of Debt Ratings, not disclosed by the company at all. It doesn’t make sense for a company to force investors to hunt for the information when the company has it readily at hand. Therefore, a well thought out section informing investors of a company’s debt profile should be included in effective investor relations web sites.

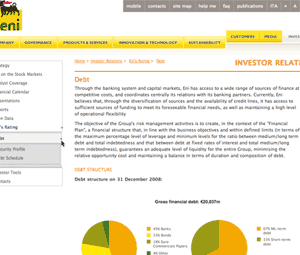

One company that does a pretty good job with their debt information is ENI, the Italian energy company. The screen shot that I have included shows a main debt page discussing their debt policy and overall debt levels. Other pages, which can be seen listed on the left of the page, debt rating, maturity (and currency) profile and the schedule of maturing debt. More companies should do this.

In this series:

Previous post: Interim financials

Next post: Mobile access

Lucy is Editor at Corporate Eye