While browsing through some archives recently, I came across … ArcelorMittal using Second Life to hold retail investor meetings – or at least, to hold a mixed reality meeting, with some people present in real life, and others present in a virtual life.

Now, I’ve talked before about using live chat for retail investor meetings, and I’ve mentioned companies using Second Life for recruiting before.

But the use of Second Life for investor meetings is interesting, and – not surprisingly – this caused a fair stir a few months ago.

Not only is the use of this technology for this purpose interesting, so too is the underlying reason: that ArcelorMittal have an aging group of retail shareholders. Apparently the average age is over 65, and, quite rightly, ArcelorMittal have identified this as a problem. (Good for them for recognising this – HR data was covered by Infohrm at their recent conference, but shareholder data is very important too).

I wonder how successful this venture was for ArcelorMittal? Apparently 50-70 avatars (or representations of people) came to the event. I’d like to know the numbers that turned up to the real-life section of the event – and how many of the people that came to the Second Life version were already investors, or were seriously interested in investing.

Is Second Life really full of people who might invest – using real life money – in ArcelorMittal?

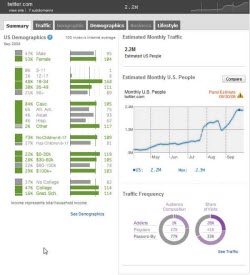

There is some information available about age-ranges, and some on how many people regularly use Second Life, but no clear indication of whether these are likely to be investors.

However, Quantcast tells us that 56% of Second Life visitors, at least in the US, earn less than $60k/year (27% earn less than $30k), and that 33% are under 18.

Possibly not ideal investor recruitment territory, then.

Nevertheless, ArcelorMittal deserve kudos for trying this out. But what else could be tried?

The average age of shareholders in the UK is (or was, back in 2006) between 35-54, and 42% of shareholders are classed as A/B (or middle/upper middle class).

The Twitter demographics from Quantcast seem to indicate that Twitter users are more likely to be shareholders: the average age of Twitter users is higher (only 1% of under 18’s), they are wealthier (29% earn over $100k/year compared to 20%) and better educated (63% college-educated compared to 52%).

Now, Twitter isn’t the same as Second Life, but it can be used as part of an online conference, so that the audience is at their desk (as for a webcast), and can see what you are displaying (perhaps a mix of webcast/video/audio/slides) and simultaneously see and participate in the related Twitter stream of comments and questions.

This takes some doing, for all parties:

The company has to

- arrange for technical control of multiple media streams

- chair the meeting of those people physically present

- incorporate the questions and comments being raised by those not physically present.

In order for this to work, the company would have to have someone dedicated to watching the Twitter stream, and summarising it for the chair, who could then invite responses from the Board members/IR team.

The participants who are not physically present have to handle multiple input streams simultaneously. Possibly, the participants who are physically present could have the Twitter stream presented on a large screen too, so that everyone has the same material available … and the same quandary about multiple simultaneous input streams. It isn’t easy to watch a webcast and simultaneously keep on top of the discussion happening on Twitter. I know, I’ve tried!

However, if your potential market is using Twitter, then I think it is worth a try – and I think ArcelorMittal is up to the challenge. I wonder if they’ve considered it?

Lucy is Editor at Corporate Eye