(This is part two of this article, inspired in part by Forbes’ Why has Corporate Social Responsibility stalled? and looking at EABIS’ Value Creation Network (PDF). Part one can be read here).

(This is part two of this article, inspired in part by Forbes’ Why has Corporate Social Responsibility stalled? and looking at EABIS’ Value Creation Network (PDF). Part one can be read here).

Restarting CSR

The key to keeping the CSR agenda going lies in the SME businesses. This is both acknowledged and discarded by the Forbes article:

Paul Klein: The vast majority of economic value is created by small and medium-sized businesses that don’t have the knowledge or resources to operationalize CSR. Is there an opportunity to engage small and medium enterprises (SMEs) in CSR and deliver social results on a scale that dwarfs what we’re seeing now?

Aron Cramer: I think that SMEs have a huge role to play … Although SMEs don’t always have the resources to formalize sustainability, every business has employees, and thinking about how they are treated is crucially important. Every SME depends on having access to water and energy that is sustainable and clean so this is an issue of importance everywhere and also a big opportunity.

If CSR is ever going to have any impact, it has to engage SMEs: in reality, the big business version which is talked about is simply the hothouse development of what has to become business norms no matter what size the business.

In this context it’s best to think of CSR like accountancy. These days, to survive in any walk of life, international conglomerate through to university student, not only do you have to have a degree of accountancy as a life skill but you have to be aware that fraud is morally and legally wrong.

Similarly, working with multiple stakeholders and meeting their needs in an equitable manner (a broad definition of the aim of CSR) should become common practice across the board from sole traders through to multinationals, otherwise sustainability will remain just an idle pipe-dream.

However, in today’s world SMEs are by and large financially entrepreneurial enterprises which are driven almost exclusively by maximising monetary return for the shareholder, whether that’s the private business owner or external investors.

It is this which the multi-stakeholder environment seeks to change, and the only place it can really change is at the SME level. There are now social enterprises starting to spring up, but these only scratch the surface of what has to happen to business governance wholesale.

What’s in a name?

Paul Klein finishes the Forbes article by musing about whether the term “social responsibility” may have had its day. “Perhaps we’re at a crossroads and need a new language around the relationship between business and social change that better captures the need for systemic solutions”, he says.

Perhaps. Or perhaps it’s a bit of a red herring. On of the commentators on the blog asks:

Are we only giving the “space” a different name, in that we will still have two sides trying to define “sustainability” and “shared value”….I mean, the fact that ‘green economy’ didn’t take off could only mean we must be still stuck at “sustainable development” or is this just a cycle?

To which Paul has replied:

There is a reason why after many years people still don’t understand what sustainability means – and we have to consider why this is.

… which strikes me as slightly unhelpful. If people don’t understand sustainability yet, why bring in a whole new language?

I’m always staggered by the human race’s desire to change what it calls things every few years or so just because it seems to give the veneer of progress.

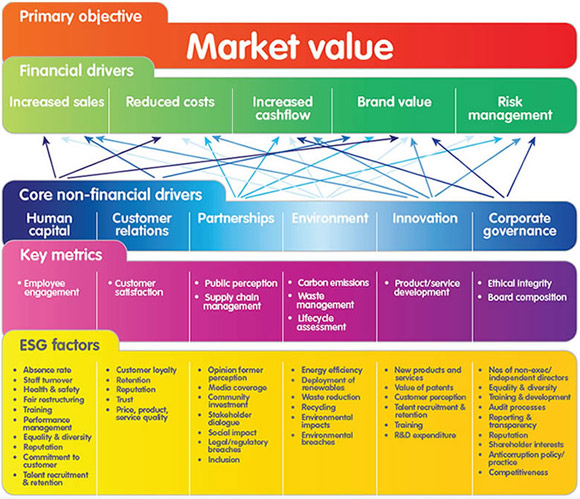

It is, after all, *only* four years since Lehman’s became the greatest exemplar of corporate responsibility gone wrong and only three years since EABIS’ Value Creation Network sought to show how a multi-stakeholder environment could promote corporate value creation to financial investors.

So I’ve used CSR throughout this piece because it’s the term the Forbes piece uses. It’s not what either of us mean because we both understand it to embrace governance and environmental factors too. But getting worked up about it, let alone positing a new lexicography, detracts from what needs to be done next.

And that’s reforming corporate governance in line with a multi-stakeholder world.

Lucy is Editor at Corporate Eye