A few days ago a Forbes blog entitled Why has Corporate Social Responsibility stalled? did the rounds. It’s an interesting read and I’m not out to criticise. However it did bring to mind some research from a few years ago.

A few days ago a Forbes blog entitled Why has Corporate Social Responsibility stalled? did the rounds. It’s an interesting read and I’m not out to criticise. However it did bring to mind some research from a few years ago.

Back in 2008, before Lehman Brothers fell flat on its face, the European Academy of Business in Society (EABIS) launched a project entitled Measuring the financial and non-financial performance of the firm.

This took the form of an extensive dialogue between businesses, academics, regulators and investors with the objective of exploring the link between ESG performance and a company’s financial success.

You can see some of the headline conclusions on the Investor Value website and download the full report Sustainable Value (PDF) from the same website.

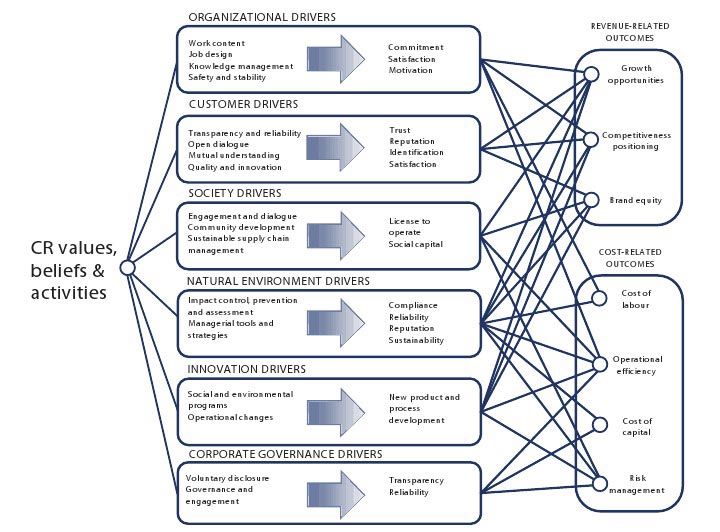

A major part of the report is the Value Creation Framework, produced by researchers from University Bocconi. They described it as CSR .. The ‘C’ stands for Complex. Looking at the Value Creation Framework model above, you can understand why!

CSR means a change in business governance

The Bocconi description of the Value Creation Framework continues:

If we want to make some progress, we need (an understanding which) which considers CSR as a strategy for dealing with stakeholders. “If CSR is considered as a new governance model based on the crucial value of stakeholder relationships and on the capacity of a firm to meet stakeholder needs beyond mere legal compliance, then a clear understanding of CSR performance consequences should disentangle different management areas and investigate how specific activities translate into organizational, managerial or market gains according to a multiple-bottom-line thinking”

Put simply, this says the dominance of the axis between business owner and financial investor needs to be broken.

That’s not to say investors don’t invest nor businesses make profits, but that relationship — almost a death clinch — should and must be reforged so that each is “just” a stakeholder in the other’s corporate entity, nothing more.

Breaking the investors’ stranglehold

This can be easily typified by Paul Klein’s opening question in the Forbes article:

On the one hand, we don’t need to talk about the business case for CSR anymore. On the other hand, being “responsible” isn’t having the impact it once did. What do you think corporations ought to be doing to increase the value of their CSR efforts?

… where “value” heavily implies profit for the business and financial value for the shareholders.

Value for other stakeholders can be brought about in many different ways by businesses. Increased wages and lower prices, greater philanthropy, or using grants instead of loans. All of these would impact monetary profits and returns, however, and so are not considered to “create value” in the current sense of the term.

This, I believe, is why CSR has appeared to have stalled. In reality it hasn’t, it’s just reached the end of one cycle of its evolution.

CSR in its modern form is about changing what businesses are, how they operate and to whom they bring value. Aron Cramer puts his finger on it in the Forbes article when he says:

The era of strict divisions between different sectors of society is over. The world is being shaped more and more by essentially hybrid organizations: businesses that look to have a positive social impact, governments that understand how they can leverage markets to achieve broader social gains, and NGOs that are looking to partner with businesses.

You cannot have hybrid organisations and multi-stakeholder environments if a business acts primarily in investors’ interests with other stakeholders having to wait in line. I would dearly love a business to say to the market “our p/e ratio will drop by XX percent for the foreseeable future because we’re going to be placing greater emphasis on stakeholders other than our financial ones”.

I’ve not heard of this happening yet. Instead you get moderately offbeat proposals such as India’s idea of legislating to ensure businesses earmark a minimum of 2 percent of their profits for CSR activities. 2 percent is hardly a seismic change in direction or stakeholder focus.

(This is the end of part one of this article. Part two can be read here.)

Lucy is Editor at Corporate Eye