Top on the list of many surveys of issues that concern Boards of Directors is Risk Management. According to The Institute of Risk Management Standard publication —

Risk can be defined as the combination of the probability of an event and its consequences. In all types of undertaking, there is the potential for events and consequences that constitute opportunities for benefit (upside) or threats to success (downside). …

Risk management is a central part of any organisation’s strategic management. It is the process whereby organizations methodically address the risks attaching to their activities with the goal of achieving sustained benefit within each activity and across the portfolio of all activities.

The current economic/financial crisis is supplying ample risks to corporate boards. For example, in AON’s 2009 Global Risk Management Survey

Respondents told us clearly that the crisis impacting the global economy was the number one most important risk to their organizations. Other key risks cited include staying ahead of regulatory compliance; managing business interruption; meeting the challenges of increased competition; commodity price risk; protecting reputation; managing risks associated with cash flow, supply chains, and third party liability; and hiring and retaining top talent. Every one of these risks has increased in scale and complexity given the state of the current economic environment.

If companies are overwhelmed by these risks, imagine how they impact companies’ stakeholders. Effective communications of how companies identify and deal with these risks is now an overarching issue. Therefore let us take a look at what is out there.

First one of the most comprehensive displays of risks is by Tokyo Electric Power Company —

Click on one of the Challenges and you obtain a thorough explanation of it and what the company is doing to manage it. This technique works so well that the company should use it to display other risks.

For a comprehensive description of a risk management process look no further than UK based Friends Provident an insurance and pension company. Their Internal controls and risk management process displays an extensive explanation of their risk management process and the roles of senior management.

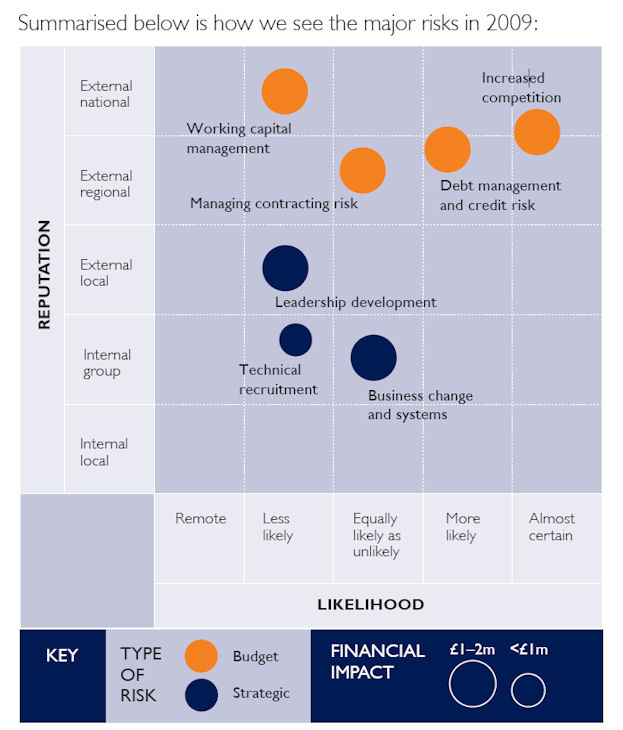

Another UK based company ROK plc uses a very effective visual to describe how it identifies risks —

This is a great example of the power visualization has in business functions. Notice how lots of information is clearly communicated. Suggestions for ROK plc, display this on your website, not only in the PDF of the Annual Report, and explain company efforts to deal with the risks.

One of the best communication of risks and how the company addresses them is on the website of The Bank of China.

This is an example of Credit Risk. Note how they describe, monitor and manage the risk. Visit their site to see how other risks are addressed.

Many companies are slow to embrace the need to clearly communicate risk management issues via their websites. The prevalent practice is to provide PDF links to their annual report. In a number of cases companies have good risk management practices but they bury them in the Annual Report. Better to take the content and enhance it to —

- Clearly describe risks by category

- Explain how the company is managing the risks

- Explain the impact on the company and quantify as much as possible

- Use visuals (see my post Business Visualization)

The companies mentioned here are good examples to use as benchmarks.

Lucy is Editor at Corporate Eye