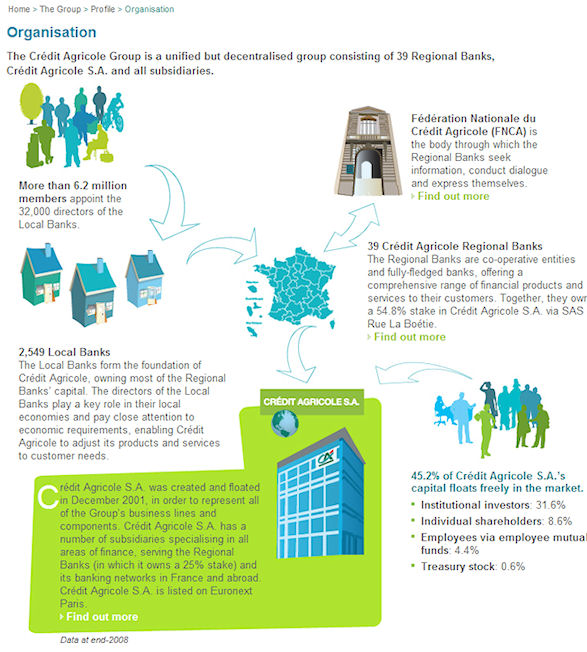

Don’t know how I missed this one, but Crédit Agricole is the largest retail bank in Europe. Their website suits this status. In the Profile section, click on Organization and access an informative visual that gives the visitor a quick view of how the company and its components are organized.

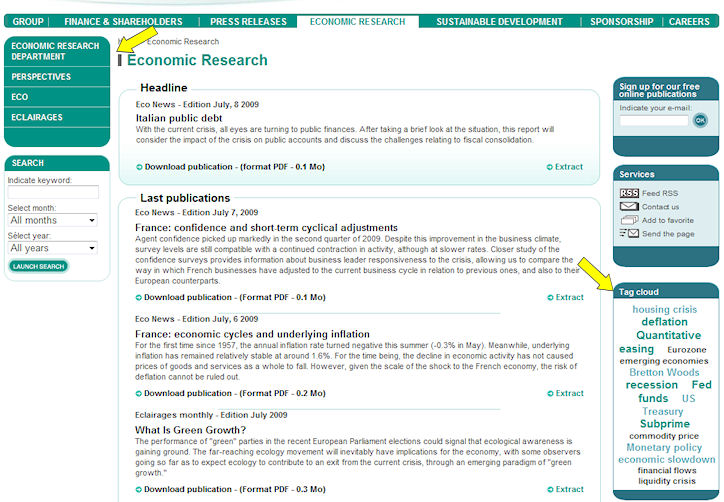

Next Economic Research is a major navigational component and for good reason. This section contains a robust supply of economic information on a very wide array of subjects.

In the upper left navigation box, you have access to–

- Perspectives

A quarterly publication setting out the Crédit Agricole scenario for the economy, interest rates and currencies in the main economic regions, ie, the Americas, Europe and Asia.

Aperiodic publication – Tabular data for Crédit Agricole economic and financial forecasts.

- Eco News

Eco News is an aperiodic publication providing up-to-the-minute analysis of a current topic.

- Eclairages

Monthly Eclairages

Éclairages is a monthly publication featuring a series of articles addressing a single issue from a range of different viewpoints. The core topic is examined according to the different specializations of teams from the Economic and Banking Studies Department: macroeconomics, country risk, banking and finance, and economic analysis of individual sectors.

Eclairages Emergents

Eclairages Emergents is an aperiodic publication offering a series of articles addressing emerging economies or an emerging region from a variety of angles.

- Eclairages Research

Eclairages Research is an aperiodic publication providing in-depth analysis of a specific topic.

An impressive menu of information and research offerings. Each topic can be viewed as a summary so you can decide if you want to download a PDF. Better if it was available as HTML and an option to download. Note the effective use of Tag Cloud that links to various topics.

My favorite section of this site is the Shareholders Corner. A link to this section is prominently displayed under the major navigation link Finance & Shareholders. This is the company’s unique method of communicating with its shareholders. What a great idea!

Skeptics might say that this is nothing new since most companies already provide this type of information. This is only partially true — Crédit Agricole goes the extra effort to provide a section that makes easy access to relevant shareholder information on one page. Note how resources are organized and see the upper right Direct Access navigation. Then there’s the Shareholder Club and Consultative Committee.

To develop close relations and regular dialogue with shareholders, Crédit Agricole S.A. set up the Shareholders’ Club in June 2002. Its main purpose is to inform shareholders, helping them understand the company, its organisation and businesses, to learn about the stockmarket and finance, and to provide them with our analysis of the economy.

The Club provides information, publications and other resources to what appears to be investors with modest holdings. Another good idea. But the pièce de résistance is the Consultative Committee —

Crédit Agricole S.A. set up in 2003 a Consultative Committee to help the company communicate as effectively as possible with its retail shareholders.

Members of the Committee are judiciously drawn from representative geographic areas —

Brilliant!

Crédit Agricole clearly is an example of how to engage a company’s most important stakeholders — Investors, including those with modest holdings.

Ed Konczal has an MBA from New York University's Stern School of Business (with distinction). He has spent the last 10 years as an executive consultant focusing on human resources, leadership, market research, and business planning. Ed has over 10 years of top-level experience from AT&T in the areas of new ventures and business planning. He is co-author of the book "Simple Stories for Leadership Insight," published by University Press of America.