Does your company offer preferred stock?

Warren Buffet’s investments in the preferred stock of several companies reignited some of the interest among the general population about preferred stock. In addition, many investors searching for yield in a market where there is little to be had in bonds and Treasuries, is looking for new alternatives, and preferred stocks might just fit the bill. But, at many companies, preferred stock is the unnoticed sibling to common stock. This just might be costing you investors.

Preferred Stock Quotes and Yields

One of the major difficulties for the common investor when it comes to preferred stock is easy access to the basic information.

While many investors have memorized the ticker symbols of numerous publicly traded companies, few have the same knowledge of preferred stock ticker symbols. The lack of standardization in this arena is partly to blame, with some companies adding a PRF and others a PR or just a P. The problem is magnified among companies with more than one publicly traded series of preferred stock. If that weren’t enough, the various services that provide quotes don’t provide preferred quotes in a standard format either, with some adding a space to the symbols, while others do not recognize such symbols.

Even if quotes are found and displayed, most online quote systems have been specifically tailored to easily and quickly display robust information about a company’s common stock. Often this leads to the information for preferred stock being displayed in a less than optimal manner.

These obstacles lead many investors to the company’s IR website looking to find both if preferred stock exists, and if so, information about the yield, dividend payment history, and even the ticker symbol. However, many company IR pages don’t provide such information at a glance leaving the investor to play investor relations webpage roulette. They might find the preferred stock information, or they might not. If they don’t they may simply assume that it doesn’t exist.

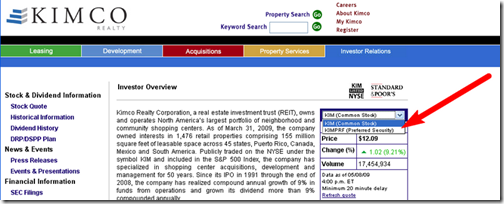

Consider US company Kimco Realty. It’s Investor Relations page landing page can be commended for having a preferred stock quote easily available, that is, if you know that it is there. The quotes is displayed for access in a drop-down box whose default display is, naturally, for the common stock. A savvy web user is likely to notice the option and click. However, many users would not notice such a detail among the sea of information provided.

While preferred stock information is always available in official filings such as the annual report, it may not seem worthwhile to an investor to crack open such documents until they have at least a cursory knowledge of what they might find, or at least a confirmation that an outstanding issue or upcoming offering does indeed exist.

Investor Relations Best Practices

While information about common stock is significantly more important than information regarding preferred stock, there can still be a place for such information on the IR website.

Most investors are well aware that preferred stock is not as universal as common stock and will be obliged to dig for such information a little bit. However, since some companies offer preferred stock and some do not (and some offer preferred stock, but not as a public offering) investors will be likely to leave assuming that there either are no preferred offerings, or that there are no preferred offerings that they may participate in. As a result, IR departments would be well advised to at least display some minimal information regarding any outstanding preferred stock offerings under the typical “Stock Information” headings.

A full chart and quote is not necessary and may simply add to the clutter on a typical stock information page, but a bold heading titled Preferred Stock with a sentence or two explaining the investor’s options, either click here for more information, or there are no publicly available preferred offerings at this time, would be a welcome addition to most stock pages.

Furthermore, while it should be intuitively obvious that a company paying common stock dividends is also paying full preferred stock dividends, a dividend history of payments for preferred stock, or a simple paragraph stating that since issue all preferred stock dividends have been fully paid could provide a welcome confirmation an investment in your company’s preferred stock has been a solid one from an income standpoint.

As always, the more information that can provided in an easily accessible manner for investors and potential investors, the better. With preferred stocks, many companies would do well just to acknowledge their existence. Then, investors may be more willing to dig into the annual report to find details.