This week, ZenithOptimedia released its “Adspend Forecast Update” for December 2010 and one type of advertising and one region of the world drew attention as the focus of opportunity for the future. In other words, companies are shifting budgets and investing more money into the large-scale opportunity of China and the lost-cost and wide-reach of the Internet.

According to the report summary, the key findings are:

- After the surprisingly strong 4.9% recovery this year, we predict annual growth of between 4.6% and 5.2% for the next three years.

- Global ad expenditure to exceed the 2008 peak in 2012.

- Developing markets to continue to grow much faster than developed markets: developing markets will account for 35.9% of ad expenditure in 2013, up from 31.5% in 2010

- Ad expenditure in newspapers and magazines to fall by 2% between 2010 and 2013. Technology to help television, cinema and outdoor grow ahead of the market, while internet advertising grows three times faster than the market as a whole.

- Display advertising now the fastest-growing internet category, driven by online video and social media.

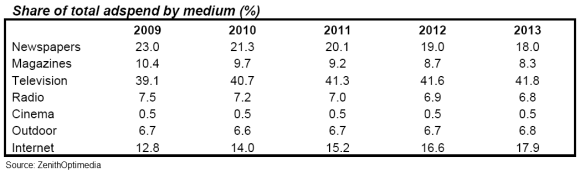

You can get a clear picture of how the shift in media investments are expected to go in the chart below:

Most media investments are expected to decrease or stay fairly even through 2013 with one exception — Internet which is expected to experience a 39.8% increase in adspend between 2009 and 2010. The next closest medium with a predicted increase is television with a 6.9% change. Clearly, we’re going to experience several years of companies and brands vying for attention and trying to learn how to best leverage the Internet to build brands and make sales.

When it comes to regional investments, the Asia Pacific region is forecasted to see major media advertising expenditures increase by 31.0% between 2009 and 2013. That’s not as high as the increases expected in Latin America (43.3%), Central Europe (39.8%) or Africa and the Middle East (32.2%), but considering that China accounts for 20% of the world’s population, the return on those advertising investments in the Asia Pacific region could be exponentially better than in any other area of the world.

Given the economic downturn that spread across much of the world in recent years, emerging markets have gained traction in terms of prioritization for advertising investments. The ZenithOptimedia forecast certainly supports the assumption that the trend will continue well into the future.

Where are you investing your advertising budget in terms of media and geographical region over the next several years? Leave a comment and share your thoughts.

Susan Gunelius is the author of 10 marketing, social media, branding, copywriting, and technology books, and she is President & CEO of KeySplash Creative, Inc., a marketing communications company. She also owns Women on Business, an award-wining blog for business women. She is a featured columnist for Entrepreneur.com and Forbes.com, and her marketing-related articles have appeared on websites such as MSNBC.com, BusinessWeek.com, TodayShow.com, and more.

She has over 20 years of experience in the marketing field having spent the first decade of her career directing marketing programs for some of the largest companies in the world, including divisions of AT&T and HSBC. Today, her clients include large and small companies around the world and household brands like Citigroup, Cox Communications, Intuit, and more. Susan is frequently interviewed about marketing and branding by television, radio, print, and online media organizations, and she speaks about these topics at events around the world. You can connect with her on Twitter, Facebook, LinkedIn, or Google+.

Hi Susan… Lots of interesting data in this report of yours! But there’s one breakdown I’m curious about and that I don’t see there, and that’s the split between Internet ad spend vs other media ad spend, on a regional basis. I have seen it said elsewhere that Internet ad spend in the UK now exceeds TV, for example, but as your figures show that’s far from the case globally. And I’m curious to know what the split/relationship is in North America and China. Do you have those available?

Thank you kindly for your trouble…

…/Scott (in Toronto)