A little less than a year ago, I began writing about the intersection of academic theory and the everyday practice of investor relations. In this post I will pause in my examination of specific disciplines and try to give an overview of why I’ve chosen five specific key disciplines.

A little less than a year ago, I began writing about the intersection of academic theory and the everyday practice of investor relations. In this post I will pause in my examination of specific disciplines and try to give an overview of why I’ve chosen five specific key disciplines.

When you are an academic, if you really want to make it big, you need to come up with a snappy way to sum up your thinking on your area of expertise.

For example, in strategy, Porter has his Five Forces – supplier power, buyer power, competitive rivalry, the threat of substitution and the threat of new entry. Similarly, in marketing, Kotler has the four Ps: product, price, promotion and place. So it occurred to me that investor relations should have a way to neatly encapsulate what it does. Seeing this as a hole in the literature on investor relations, I have decided to step into the void and propose (with apologies to T. E. Laurence and the Seven Pillars of Wisdom), the Five Pillars of Investor Relations.

I choose the wording of pillars because they are the skills needed to form a strong support base for an investor relations program (also, I couldn’t come up with a clever acronym or make everything begin with the same letter). Plus, this allowed me to create a clever visual slide for my class featuring Greek columns to drive the point home. So, without further ado, here is a brief description of what I consider to be the essential skill and knowledge requirements to do investor relations well—the five pillars of investor relations.

- FINANCE – It is essential that a good investor relations officer have a thorough understanding of the components of his company’s income statement, balance sheet and cash flow statement, as well as the accounting treatments they derive from. On the theoretical side, the IRO needs to be comfortable with the different valuation models used by Wall Street to value his company’s stock and the role of investor relations in the efficient markets.

- MARKETING – How to segment the investment universe, target appropriate investors and position the company story to appeal to those investors are basic marketing skills that are critical to good IR. At a deeper level, using marketing techniques to more efficiently use limited resources to focus on the most important investors can help IR have a bigger impact.

- COMMUNICATIONS – Crafting a memorable message that resonates with investors is a critical communications skill that is used in IR. This is closely followed by figuring out what disclosures, above and beyond those mandated by regulations, will assist investors in understanding the intrinsic worth of a company. All of this presupposes a solid understanding of your company and industry. Finally, the skilled use of multiple communications channels is becoming ever more important as new means of communication such as social media proliferate.

- LAW – Everything in investor relations is circumscribed by laws, regulations and case decisions. While this will vary by jurisdiction, generally legal requirements will cover everything from what you say (or at least the minimum of what you must say) through periodic reporting requirements and other mandated disclosures, to when and to whom you say it and, to why you say it. Understanding the ins and outs of the legal requirements is critical to doing things right in investor relations.

- CAPITAL MARKETS – Knowledge of how the stock markets work is an essential skill of the investor relations officer. If you don’t think so, try telling your CEO that you don’t really understand what the markets are doing the next time he sticks his head into your office and asks why the stock is trading down. Understanding liquidity, volatility, auction markets and the other things that impact the way your stock is traded is essential for investor relations. Knowing the key players in the market for your stock, how they may interact and how to access information about them quickly are necessary tools for an IR department.

Well, there you have it: The Five Pillars of Investor Relations. With luck it will give you a framework to think about investor relations in its entirety.

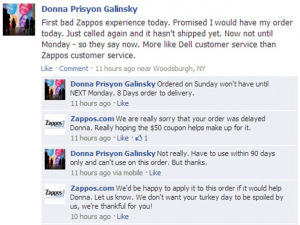

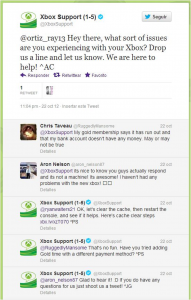

Many people make the mistake of believing that social media is simply a sales or marketing tool. In fact it is one of the most rounded tools any business can use, aiding in areas such as market research, business development, and most importantly, customer service.

Many people make the mistake of believing that social media is simply a sales or marketing tool. In fact it is one of the most rounded tools any business can use, aiding in areas such as market research, business development, and most importantly, customer service.

A new study by the Chief Marketing Officer (CMO) Council, the CMO Council’s ROI Center, and NetLine found that 85% of business-to-business (B2B) buyers are either majorly or moderately affected by online content from B2B marketers when making vendor selection and purchase decisions. However, B2B buyers don’t believe that B2B marketers are creating online content that offers enough value or is trustworthy. Content published by industry groups and professional organizations is considered to be both more valuable and more trustworthy.

A new study by the Chief Marketing Officer (CMO) Council, the CMO Council’s ROI Center, and NetLine found that 85% of business-to-business (B2B) buyers are either majorly or moderately affected by online content from B2B marketers when making vendor selection and purchase decisions. However, B2B buyers don’t believe that B2B marketers are creating online content that offers enough value or is trustworthy. Content published by industry groups and professional organizations is considered to be both more valuable and more trustworthy.