Between 2011 and 2012, consumer packaged goods (CPG) advertisers tripled mobile advertising spending. That data comes from the Millennial Media Mobile Intel Series released this week which tracked its own ad partners and combined that data with research from comScore. According to the report, mobile ad spending among CPG advertisers increased by 235% from 2011 to 2012.

Between 2011 and 2012, consumer packaged goods (CPG) advertisers tripled mobile advertising spending. That data comes from the Millennial Media Mobile Intel Series released this week which tracked its own ad partners and combined that data with research from comScore. According to the report, mobile ad spending among CPG advertisers increased by 235% from 2011 to 2012.

During the research period, 82% of CPG mobile ad impressions were tracked on smartphones while 18% were tracked on tablets. Mobile advertisers most frequently targeted consumers in five demographic buckets: foodies, pet owners, parents, avid shoppers, and household shoppers. Furthermore 40% of mobile advertisers tracked in this study used location targeting to maximize campaign ROI.

The biggest CPG mobile ad spenders identified in the Millennial Media research were beverages (43% of campaigns), cosmetics and hygiene, food, household products, and pet products. For the majority of these campaigns (46%), the primary goal was to raise brand or product awareness. Interestingly, Jack Neff of AdAge points out that this is a significantly higher percentage than is seen in overall mobile advertising where just 14% of campaigns have a primary goal of raising awareness.

The most interesting data for CPG mobile advertisers revealed in this study offers insights into how consumers use their mobile devices to gather information about consumer packaged goods as they’re in a store and actively shopping. According to the report, men are more likely to use their mobile devices while in a store than women to check product availability (47% of men versus 39% of women), compare prices (51% of men versus 38% of women), and find coupons or deals (47% of men versus 40% of women). On the other hand, women are more likely to use their mobile devices while in a brick-and-mortar store to take a picture of a product (29% of women versus 21% of men) and text or call family or friends about a product (51% of women versus 37% of men).

Based on these study results, CPG mobile advertisers are missing opportunities to get the right information in front of consumers when they’re in a store making a purchase decision. By focusing primarily on raising awareness, the 235% increase in CPG mobile ad spending between 2011 and 2012 was over-invested in awareness campaigns. A more balanced approach of awareness campaigns and campaigns that drive in-store purchases by providing the right information at the right time directly to consumers’ mobile devices will deliver better results.

Many CPG advertisers have figured this out and are making the necessary strategic shifts in their mobile advertising plans. Is your company one of them?

Image: Murat Cokal

According to research by

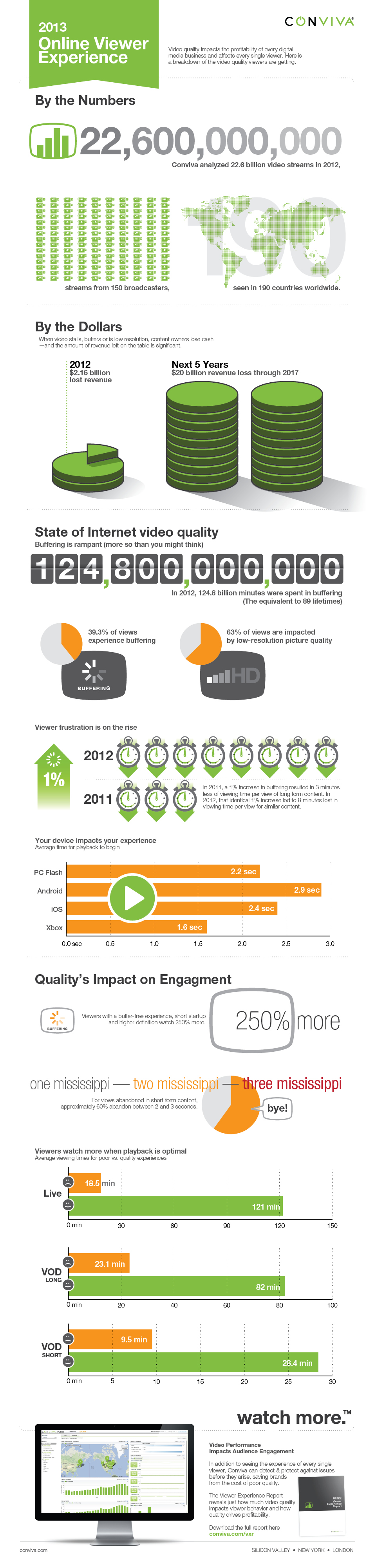

According to research by  Brand video is an important part of a content marketing plan, but the opportunity that brand video presents is significantly reduced if the quality of those videos is low or the viewer experience is damaged from buffering and slow load times. Specifically, video buffering or low resolution video lead to $2.16 billion in lost revenue for online video publishers in 2012.

Brand video is an important part of a content marketing plan, but the opportunity that brand video presents is significantly reduced if the quality of those videos is low or the viewer experience is damaged from buffering and slow load times. Specifically, video buffering or low resolution video lead to $2.16 billion in lost revenue for online video publishers in 2012.

Can EBay join the ranks of digital advertising success that Google, Facebook, and Amazon have dominated in recent years? It certainly looks like the company expects to answer that question with a resounding, “Yes,” in the near future based on Stephen Howard-Sarin’s (head of eBay digital display in North America) announcement to the audience at AdExchanger’s Programmatic I/O conference yesterday.

Can EBay join the ranks of digital advertising success that Google, Facebook, and Amazon have dominated in recent years? It certainly looks like the company expects to answer that question with a resounding, “Yes,” in the near future based on Stephen Howard-Sarin’s (head of eBay digital display in North America) announcement to the audience at AdExchanger’s Programmatic I/O conference yesterday.