Corporate Governance is in the news–again. Despite recent laws such as Dodd-Frank in the US, Corporate Governance continues to be a problem. Recent events such as the bankruptcy of MF Global, the $5.8 billion trading loss at JP Morgan and the trial of Rajat Gupta all indicate that good Corporate Governance is still wanting. An article in The European Financial Review states–

The systemic failure of corporate governance is particularly associated with the Anglo-American corporate governance model that has enabled, permitted or tolerated excess power and wealth at the hands of CEOs and cultivated a ‘greed-is-good’ culture in banks.

Then there is an excellent article Corporate Apocalypse that traces the foundations of the recent Economic Crisis back to the 1950s — and states

The financial crisis is both a failure of the invisible hand of market and a failure of the visible hand of management

Seems that it may be time to revisit the fundamentals of what is Corporate Governance.

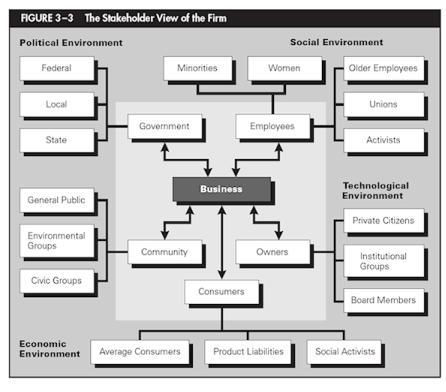

This post will be the first of a series that will look at the fundamentals of Corporate Governance and posit examples of best practices. Let’s look at the purpose of Corporate Governance. It starts with stakeholders.

Key to the success of a business are the returns for the owners: the shareholders. However, business is increasingly becoming aware that its goal must be balanced with the interests of other stakeholders.

A company has a number of stakeholder groups. Primary groups include –

- Owners and shareholders (public companies)

- Employees

- Customers

- Communities

- Government

There are other subgroup stakeholders as indicated in this visual:

Source: Carol Buchholtx, Business and Society

Anglo American, a large resources company, provides a good example of a corporate statement on managing the interests of stakeholders in a balanced manner.

Our responsibilities to our stakeholders

Our primary responsibility is to our investors. We seek to maximize shareholder value over time. We believe that this is best achieved through an intelligent regard for the interests of other stakeholders, including our employees, the communities affected by our operations, our customers, and business partners. A reputation for integrity and responsible behaviour underpins our commercial performance, gained by motivating employees and building trust and goodwill.

Corporate Governance is the combination of procedures, polices, systems, laws and regulations through which a company is organized and controlled. In doing so, it guides the relationships between internal and external stakeholders. Much has been written about shareholder vs. stakeholder Corporate Governance models. These are typically defined as–

Corporate Governance Model | Geography | Key Items |

| Anglo-Saxon | United States, United Kingdom, Canada and Australia |

|

| German-Scandinavian | Germany, Austria, West Europe, Japan |

|

| Emerging Markets | China, Russia, South America, India |

|

| Based on “Challenges of Governing GLOBALLY”, by Marc J. Epstein, Strategic Finance, July 2012 (PDF) | ||

The trend is toward the stakeholder balance model. More about this in future posts.

Key Takeaways

- The definition of Corporate Governance is rather simple. Its execution is not.

- Corporate Governance involves different stakeholders both internal and external to the organization.

- There are different models of Corporate Governance and they vary by geography.

Air New Zealand launched its new logo recently, but consumers aren’t happy (read the

Air New Zealand launched its new logo recently, but consumers aren’t happy (read the  New Logo

New Logo

The

The