When most people are children, they want to be someone special when they grow up; nobody ever wants to be just another anonymous person. So growing up and even later in life, we all foster a belief in our unique combination of talents and characteristics that make us a special person (at least to our spouses, children and dogs).

When most people are children, they want to be someone special when they grow up; nobody ever wants to be just another anonymous person. So growing up and even later in life, we all foster a belief in our unique combination of talents and characteristics that make us a special person (at least to our spouses, children and dogs).

And so it is with companies as well. Every company strives to be unique. In business school they give it the fancy name of differentiation, but the concept is clear: your product or service offering needs to stand out from the competition. Even if your product is simply a ‘me too’ offering, there needs to be something that makes it more attractive in some aspect, whether that be price, delivery mechanism or simplicity of use, that will cause the customer to part with their money.

To take this analogy one step further and apply it to investing, if investors can be shown that a company occupies a unique position in the marketplace, they are more likely to understand the underlying investment thesis of the company and buy the stock.

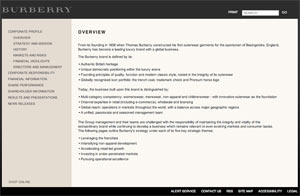

Take for example Burberry, the British apparel company. The firm has traditionally been thought of as a manufacturer of traditional trench coats, but more recently has pushed into fashion. How is an investor supposed to think of this?

Burberry addresses this in their corporate profile page, which I’ve set out here. After reading the page, an investor has a pretty good idea of why Burberry thinks of themselves as unique, and how they plan to use that attribute to grow the company.

So the takeaway here is clear: by telling investors why your company is special, you can help them focus on the reasons to own your stock.

In this series:

Previous post: Investment Case

Next post: Key Performance Indicators

I’ve written about the

I’ve written about the