In my last post I had a reference to Financial Literacy Education. In Europe this is known as Financial Capability. Many financial services companies are rushing to provide some type of financial education to existing and potential clients. What is behind the rush?

A number of developments converged to produce the 1000 year financial storm–

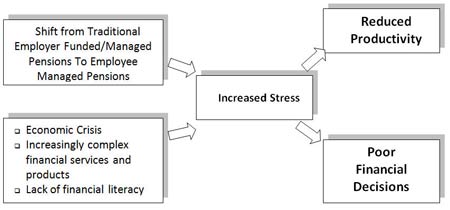

The global economic crisis, more complex investment choices and the shift of pension investment choices from the employer to the employee, when combined with widespread financial illiteracy, is causing increased stress among a significant number of the public.

Research suggests that 15–20 percent of employees have financial problems severe enough to negatively affect productivity. A financially stressed employee spends an average of 20 hours per month of work time on his/her personal financial problems.

The Case For Financial Education at the Workplace

The Federal Reserve Bank of Kansas City, The Federal Reserve Bank of Atlanta

Too many people fail simple tests on the basics of compound interest and basic financial math. The result: poor financial decisions such as not investing in company-offered voluntary investment plans. This worsens individuals’ financial condition and puts their retirement at risk.

Many financial services companies, banks, credit unions and financial advisory firms are offering a variety of financial literacy education resources.

Some examples in the US

Bank Of America FINANCIAL TOOLS

Wells Fargo HANDS ON BANKING

CitiBank FINANCIAL CAPABILITY

Examples from Europe

Barclay’s BUILDING FINANCIAL CAPABILITY

Halifax MANAGING YOUR MONEY

Caixa Galicia SECURE YOUR FUTURE

Some are critical of these programs. They indicate the motivation is to restore the tarnished reputations of the financial services sector. Perhaps, but the educational services offered do assist in helping individuals to improve their knowledge of financial matters.

This subject is important enough to warrant additional posts in the future.