The Economic crisis and the collapse of financial companies has and will continue to supply the news media with an ample supply of material for reporting.

Yet most of the institutions at the epicentre of the crisis remain silent.

Perhaps Ben W. Heineman Jr., GE’s former senior vice-president for law and public affairs, says it best —

Where are the chief executive officers, top management and corporate directors of the world’s financial institutions? Their failures, that familiar litany of excess leverage, indecipherable financial instruments, poor risk management and woeful

compensation systems, are the main catalyst for these unprecedented problems. There has been a stunning silence on private-sector causes and private-sector cures from the private sector itself. This is unconscionable, because their lapses raise

profound political and economic questions about the balance between government regulation and corporate self-determination.

Ouch!, yet deserving. Where indeed are these “captains of industry”, who were so visible during the good times? Rather then focusing on the communications gaffes, let us take a look at those companies that stepped up to the communications task.

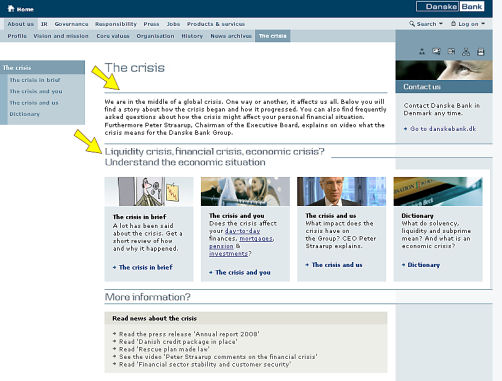

DanskeBANK is one of the standouts. They have a section on their website that does an admirable job of explaining the crisis and how it affects the Bank and its customers —

This section called “The Crisis” is an informative and insightful resource. This is a model for other companies.

Another company doing the right things for communications to stakeholders is Northwestern Mutual—

Noteworthy items include a low-key approach (a welcome alternative to hype) and a notice that the CEO received a Ethics award. The company also uses a time tested tool to build trust: testimonials. These are real stories that anyone can relate to. The fact that people are willing to use their names is telling. Northwestern is another good example of communications during the current crisis.

Finally, there is a good read “Corporate Communications in Financial Crisis: The New Paradigm“.

Some key points include —

Be for Something. With public trust in Corporate America and Wall Street at an all-time low, no amount of explanation or finger-pointing will salve the wound. Instead, the business community needs a leader, or leaders, to show everyone the way out. There is a hunger for this kind of forward-looking leadership – and the longer the marketplace goes without it, the harder it will be to convince stakeholders that it’s even possible.

Limit the excesses. The first companies to effectively define themselves as “anti-perk” institutions are the ones that will assume the leadership position articulated above. Consider the example of John Reed, who took the helm of a struggling New York Stock Exchange for an annual salary of one dollar in 2003. That’s the kind of decisive action needed now because it communicates a commitment to the new way forward in deed, rather than word. With the Dodd Amendment already limiting compensation at banks that accept TARP funds, companies are wise to identify ways to adjust their compensation structure, award non-cash bonuses (e.g. restricted stock), and cut back on the frills that have already landed companies in hot water.

If under investigation, cooperate, cooperate, cooperate. New SEC Chairwoman Mary L. Schapiro has already moved to do away with an existing rule that requires enforcement division lawyers to seek the approval of Commissioners before negotiating penalties. To be sure, the SEC is on the lookout for villains to use to burnish its watchdog credentials. If your company lands in the spotlight, now is not the time to either fight nor hide. Today, companies can assume one of two roles – poster child of reform, or poster child for reform. Cooperation that goes above and beyond mere compliance is the best way to ensure that your company never gets cast in the wrong role.

Deliver bad financial news early and all at once. Such an approach may seem counter-intuitive – and frightening – but it is a critical strategic approach that subsequently defines how a negative story is felt and seen by your most important constituencies. Do not let the drip-drip-drip of rumor and/or real negative news play out publicly in the marketplace. Today, assumptions are almost always worse than the truth.

As always, but especially in tough times, leaders need to get out of their offices and do what they are paid to do — LEAD with Integrity.

I often write about how important employees are as the ultimate brand advocates and ambassadors next to consumers. If your employees are treated well and truly believe in your company and your brand, then they’ll talk about it, and they’ll influence others. In the end, your sales will rise. But would your employees where Mardi Gras costumes, complete with beads, masks and more, for you?

I often write about how important employees are as the ultimate brand advocates and ambassadors next to consumers. If your employees are treated well and truly believe in your company and your brand, then they’ll talk about it, and they’ll influence others. In the end, your sales will rise. But would your employees where Mardi Gras costumes, complete with beads, masks and more, for you?

In a what must be a painful decision, U.S. brewery Anheuser-Busch lost the right to use the brand name Budweiser in the European Union after a long legal battle with Czech brewer Budejovicky Budvar finally came to an end.

In a what must be a painful decision, U.S. brewery Anheuser-Busch lost the right to use the brand name Budweiser in the European Union after a long legal battle with Czech brewer Budejovicky Budvar finally came to an end.